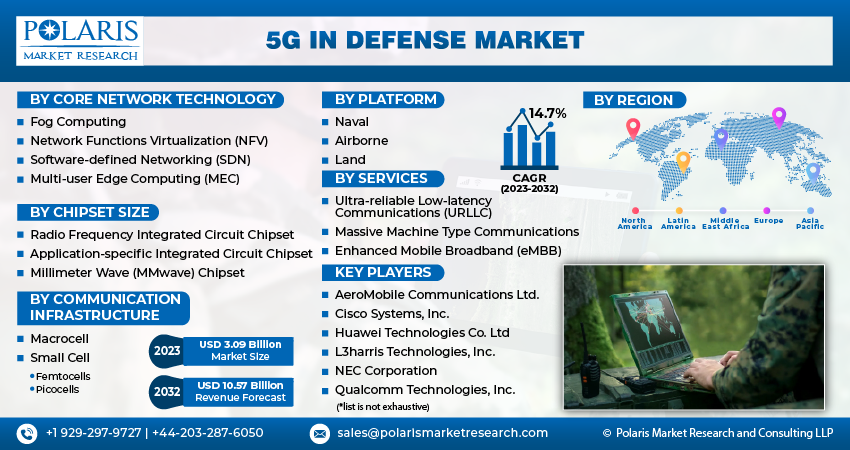

5G in Defense Market Share, Size, Trends, Industry Analysis Report, By Communication Infrastructure (Macrocell, Small Cell); By Core Network Technology; By Chipset Size; By Platform; By Services; By Region; Segment Forecast, 2023 - 2032

- Published Date:Nov-2023

- Pages: 118

- Format: PDF

- Report ID: PM4020

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

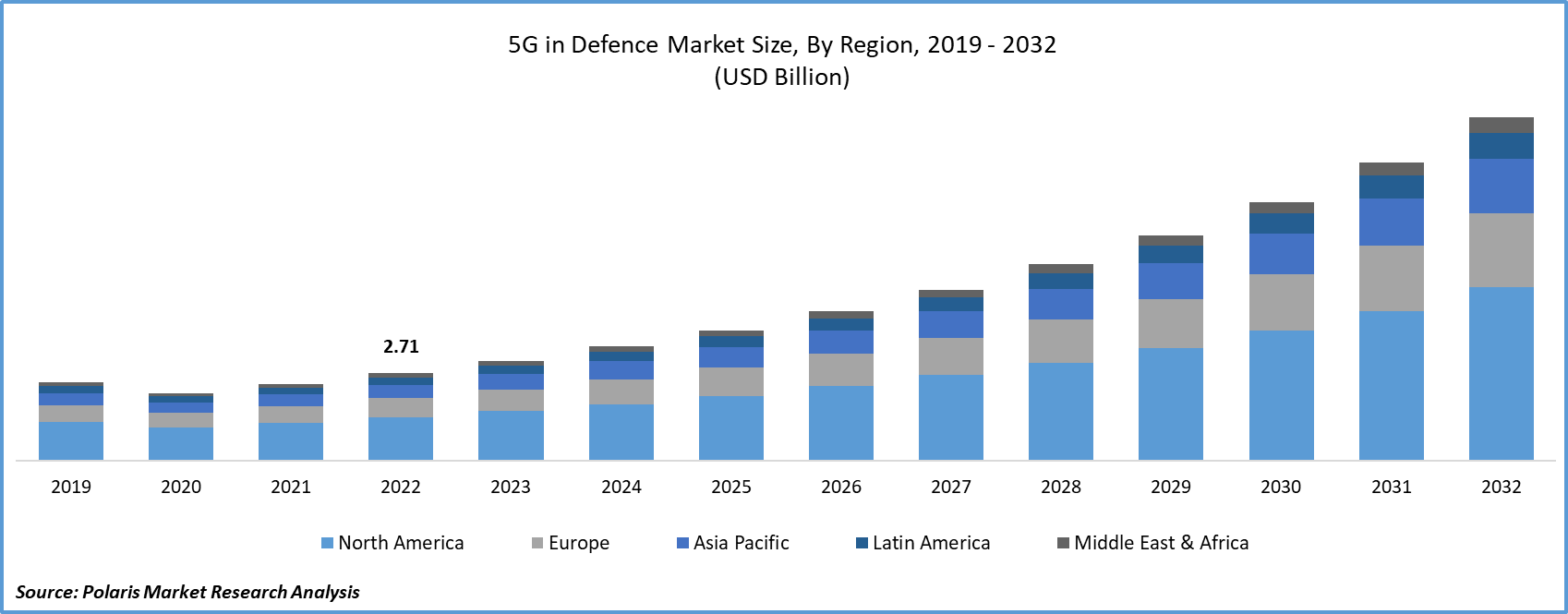

The global 5G in Defense market was valued at USD 2.71 billion in 2022 and is expected to grow at a CAGR of 14.7% during the forecast period.

The anticipated revenue growth in the global 5G defense market is poised to be fueled by several key factors, including a surging demand for the Internet of Things (IoT), an increasing reliance on big data for decision-making, a growing need for automation in military and defense sectors, and heightened government investments in 5G technology, networks, and infrastructure. The expansion of IoT applications within the military is expected to be a significant driver for market revenue growth. IoT integration empowers military systems equipped with sensors and software to establish connections and data exchange via the Internet. This elevates the demand for 5G networks due to the technology's low latency, enabling swift connectivity and data sharing among IoT devices.

To Understand More About this Research: Request a Free Sample Report

The escalating reliance on big data for strategic decision-making is set to further enhance the demand for 5G networks in fortifying defense equipment. The increasing utilization of real-time data for critical decision-making has resulted in the accumulation of extensive data volumes. 5G networks are poised to facilitate the efficient management of big data with swifter and more reliable connectivity. In particular, 5G wireless networks will enable the rapid transfer of data from Unmanned Aerial Vehicles (UAVs) and surveillance drones to command centers in real time, thereby elevating situational awareness and tactical reconnaissance.

The increasing dependence on big data for strategic decision-making is poised to bolster the demand for 5G networks in strengthening defense equipment. The rising reliance on real-time data for crucial decision-making has led to the accumulation of vast data volumes. 5G networks are well-positioned to facilitate the efficient management of this wealth of data through faster and more reliable connectivity.

In particular, 5G wireless networks will enable the swift transmission of data from Unmanned Aerial Vehicles (UAVs) and surveillance drones to command centers in real-time, enhancing situational awareness and tactical reconnaissance. The growing necessity for automation within the military sector will catalyze the 5G in defense market's expansion. 5G technology offers end-to-end slicing capabilities, tailoring network performance to meet the specific requirements of various military applications, including automated vehicles and production processes. This, in turn, enables more efficient resource utilization, encompassing spectrum and bandwidth optimization.

For Specific Research Requirements: Request for Customized Report

Moreover, the enhanced bandwidth of 5G holds the potential to revolutionize logistics and supply chain management by providing real-time tracking of supplies in transit through various sensors. Furthermore, increased government investments in 5G infrastructure represent another significant driving force behind the growth of the global 5G defense market. A notable example of such investments is the U.S. Department of Defense (DoD) awarding USD 600 million in October 2020 for 5G experimentation and testing at five U.S. military test sites.

Industry Dynamics

Growth Drivers

- The market is driven by the elevation of growing situational awareness through 5G technology.

In the field, public safety officials serve a dual role, contributing to and benefiting from enhanced situational awareness. They provide valuable body-mounted cameras, data through sensors, and direct observations, optimizing decision-making by accessing both on-site and remote information sources.

This capacity for public safety agencies to exchange actionable intelligence not only enhances personnel management but also fosters coordination among various units and agencies. The high-speed, low-latency capabilities of 5G technology offer significant advantages to public safety operations, with virtual reality (VR), drone-acquired data, augmented reality (AR), and real-time situational intelligence playing pivotal roles.

5G's high-speed data transmission enables real-time or near-real-time data collection, processing, and distribution, incorporating information from diverse sources such as sensors, satellites, drones, and surveillance systems. This rapid processing and dissemination provide a comprehensive view of the operational environment.

To ensure effective situational awareness, the use of appropriate data capture solutions like wearables, cameras, sensors, and drones, combined with mechanisms for data analysis and prioritization, supports quicker and more informed decision-making.

Report Segmentation

The market is primarily segmented based on Core Network Technology, Chipset Size, Communication Infrastructure, Platform, Services, and region.

|

By Core Network Technology |

By Chipset Size |

By Communication Infrastructure |

By Platform |

By Services |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Communication Infrastructure Analysis

- The Macrocell segment held the largest revenue share in 2022

The macrocell segment is poised to take the lead in terms of revenue contribution to the global 5G defense market throughout the forecast period. A macrocell, which is a crucial component of the radio access network, offers extended coverage with lower-frequency waves capable of penetrating physical obstacles. Typically mounted on towers, macrocells enable the provision of 5G network services over a broader area, resulting in reduced system response times.

By Core Network Technology Analysis

- The Multi-user Edge Computing (MEC) segment accounted for the highest market share during the forecast period

The revenue of the Multi-access Edge Computing segment is expected to exhibit a rapid compound annual growth rate (CAGR) during the forecast period. This growth is attributed to the increasing adoption of MEC-enabled 5G wireless systems, providing low-latency and high-bandwidth network access. MEC technology empowers data collection and processing at the network's edge, enabling real-time analytics, reduced cloud data storage, and enhanced network security.

By Services Analysis

- The Ultra-reliable Low-latency Communications (URLLC) segment accounted for the highest market share during the forecast period

The Ultra-reliable Low-latency Communications (URLLC) segment is poised to dominate in terms of revenue contribution to the global market over the entire forecast period. The 5G network, renowned for its extraordinary speed, is projected to be 100 times faster than the 4G network, primarily owing to its low latency characteristics. When coupled with the adoption of edge computing, this will usher in a transformation of military communication systems. This advancement enables expedited decision-making in times of conflict and bolsters target recognition in reconnaissance operations. Consequently, the demand for URLLC services in military applications is set to experience a substantial upswing.

Regional Insights

- North America dominated the largest market in 2022

North America is projected to secure a significant share of the revenue in comparison to other regional markets throughout the forecast period. This is mainly attributed to the augmented government investment in experimenting and testing 5G networks. Moreover, the rising need for high-speed and secure connections for military communications is anticipated to further propel revenue growth in the 5G defense market within this region.

Asia Pacific is anticipated to record a notably accelerated growth rate in terms of revenue during the forecast period. This surge is attributed to the growing military modernization efforts, driven by heightened Chinese activities in the region and the increased deployment of unmanned vehicles and AI-enhanced military technologies. For instance, in April 2021, China inaugurated a 5G signal station in the Himalayan region of Tibet to enhance network access for its border security forces, exemplifying the region's investment in advanced technology.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- AeroMobile Communications Ltd.

- Cisco Systems, Inc.

- Huawei Technologies Co. Ltd

- L3harris Technologies, Inc.

- NEC Corporation

- Qualcomm Technologies, Inc.

- Raytheon Technologies Corporation

- Telefonaktiebolaget LM Ericsson

- Thales Group

Recent Developments

- In February 2023, Nokia revealed its historic selection by MTN South Africa (MTN SA) as one of its 5G Radio Access Network (RAN) equipment providers for the first time.

- In February 2023, The US Navy has entered into a research collaboration agreement with Qualcomm to jointly explore 5G, artificial intelligence, and cloud computing technologies.

5G in Defence Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3.09 billion |

|

Revenue forecast in 2032 |

USD 10.57 billion |

|

CAGR |

14.7% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Core Network Technology, By Chipset Size, By Communication Infrastructure, By Platform, By Services, , By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |