5G Fixed Wireless Access (FWA) Market Share, Size, Trends, Industry Analysis Report, by Offering (Hardware, Services); By Demography (Urban, Semi-Urban, Rural); By Application (Residential, Commercial, Industrial, Government); By Regions - Segment Forecast, 2024 –2032

- Published Date:Sep-2024

- Pages: 118

- Format: PDF

- Report ID: PM1717

- Base Year: 2023

- Historical Data: 2019-2022

5G Fixed Wireless Access Market Overview

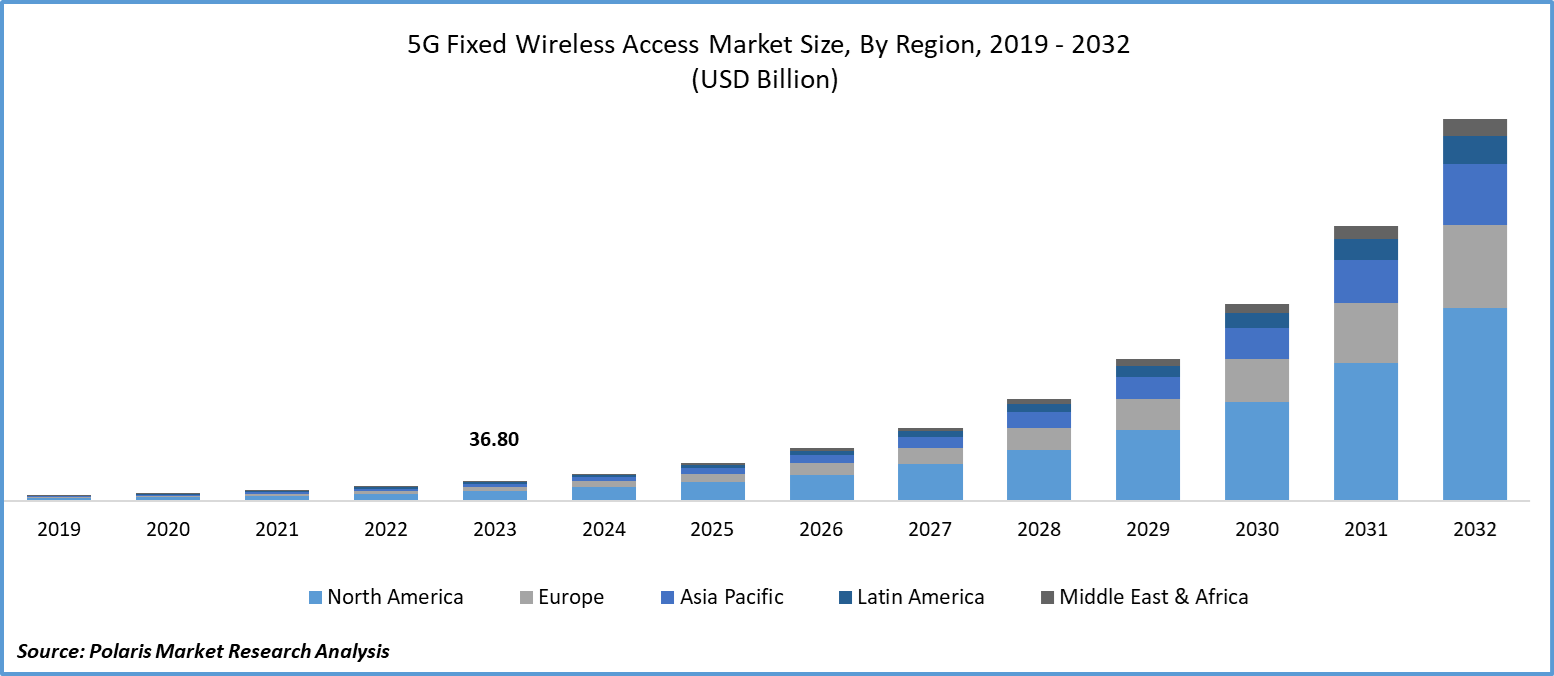

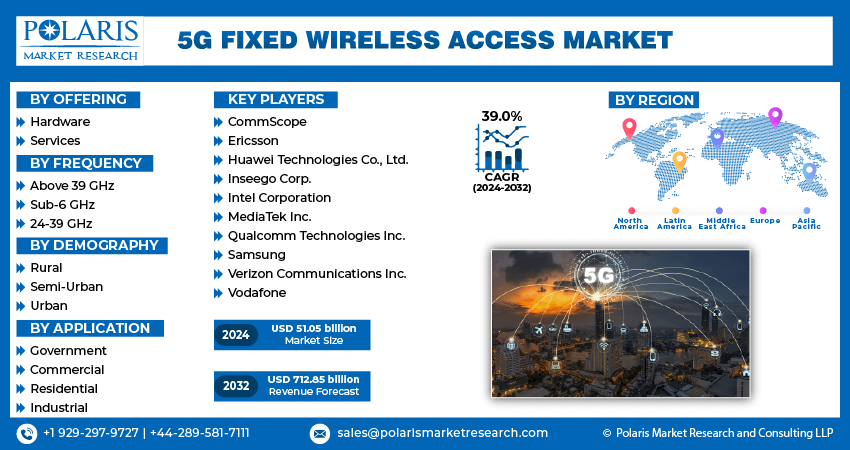

Global 5G fixed wireless access market size was valued at USD 36.80 billion in 2023. The market is projected to grow from USD 51.05 billion in 2024 to USD 712.85 billion by 2032, exhibiting a CAGR of 39.0% during the forecast period.

The 5G fixed wireless access uses 5G technology to provide internet access to homes and businesses without the need for wired connections such as fiber optic cables.

The 5G fixed wireless access market is experiencing robust growth driven by the expansion of the Internet of Things (IoT) and smart home devices. The 5G fixed wireless access enables direct high-speed broadband connectivity and reliable internet services for devices that allow real-time communication.

Additionally, it allows broadband services to both residential consumers and small to medium-sized enterprises on a broad scale to maintain faster speed and lower latency, thus boosting the 5G fixed wireless access market growth.

To Understand More About this Research:Request a Free Sample Report

Further, telecommunications companies are another major contributor to the expansion of the 5G fixed wireless access market size. Key players are expanding their product offerings and coverage and improving service quality. They are also investing in infrastructure and technology development to deploy 5G services efficiently. This expansion allows high-speed internet access to more areas, enabling more consumers and businesses to adopt 5G fixed wireless services.

For instance, in September 2022, Ericsson introduced the 5G radio solution, providing a compact and adaptable option to extend 5G coverage cost-efficiently. The Radio 6646 enhanced wide-area coverage and inside-out reach from rooftops and towers to indoor settings like offices, stores, basements, and residences. Additionally, it boosted the capacity of 5G networks utilized in conjunction with mid-band TDD and 5G Standalone (5G SA).

5G Fixed Wireless Access Market Drivers and Trends

Technological Advancements in 5G Fixed Wireless Access

The growth of the 5G fixed wireless access market is being propelled by technological advancements aimed at boosting the capabilities and efficiency of network infrastructure. These advancements encompass improvements in beamforming techniques, spectrum utilization, and other factors, which enable higher data throughput and improved coverage.

The enhanced mmWave deployment utilizes hybrid beamforming to improve performance and provide versatile infrastructure choices. Advanced wireless AI enables seamless integration across various devices and networks. Further, digital twin network is deployed for instant wireless system modeling to elevate user satisfaction.

For instance, in February 2024, ZTE launched 5G+AI at the Mobile World Congress Barcelona 2024 to enhance the adoption of integrated communication and commuting, revolutionizing various industries.

Advanced technologies provide the scalability and reliability needed to meet the increasing demand for high-speed internet, further accelerating the adoption of 5G fixed wireless access by consumers and enterprises.

Increasing Demand for High-Speed Internet is Driving the Market Growth

The 5G fixed wireless access market is experiencing significant growth, driven by the surge in demand for high-speed internet to enhance network performance capabilities and offer more high-speed network coverage.

The emergence of 5G technology has enabled fixed wireless access to provide high-speed internet to residences and businesses in locations with restricted fiber or cable infrastructure. As 5G networks extend and encompass more users, there will be a surge in the adoption of 5G fixed wireless access technology, especially in regions with limited or non-existent wired infrastructure, driving the 5G fixed wireless access market revenue.

For instance, according to a report published by Erricson, there was a surge in the percentage of fixed wireless access service providers that offer speed-based tariff plans from 27% in 2023 to 40% in 2024. In North America, 80% of the service providers offered speed-based 5G fixed wireless access. Further, it is projected that there will be over 330 million 5G fixed wireless access connections by 2029.

5G Fixed Wireless Access Market Segment Insights

5G Fixed Wireless Access Market Breakdown by Offering Insights

The global 5G fixed wireless access market segmentation, based on offering, includes hardware and services. In 2023, the services segment dominated the market, owing to the increasing need for internet connectivity. Businesses and consumers are seeking faster and more dependable connections due to the rising number of data-intensive applications and the emergence of the Internet of Things (IoT) professional services.

The high bandwidth and low latency of 5G fixed wireless access networks address these requirements, enabling service providers to expand their offerings. For instance, in July 2024, Deutsche Telekom (DT) enhanced its B2B services in Brazil by introducing 5G fixed wireless access services, which will provide machine-to-machine (M2M) mobile connectivity for Internet of Things (IoT) devices.

5G Fixed Wireless Access Market Breakdown by Application Insights

The global 5G fixed wireless access market segmentation, based on application, includes government, commercial, residential, and industrial. In 2023, the residential category dominated the market, mainly attributed to the telecom operators that are expanding their coverage and improving network reliability for streaming, gaming, remote work, and smart home applications.

Moreover, the 5G fixed wireless access offers faster internet speeds and more dependable connectivity, making it an appealing choice for residential consumers. For instance, in May 2024, Jio reported a surge of 3% in residential users of 5G fixed wireless access as compared to 0.35 million in April 2024.

Further, the escalating need for high-speed broadband has led to an increase in the number of individuals adopting internet-based services. For instance, in March 2024, according to a report published by Forbes, there were 5.35 billion internet users globally in 2023.

Global 5G Fixed Wireless Access Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

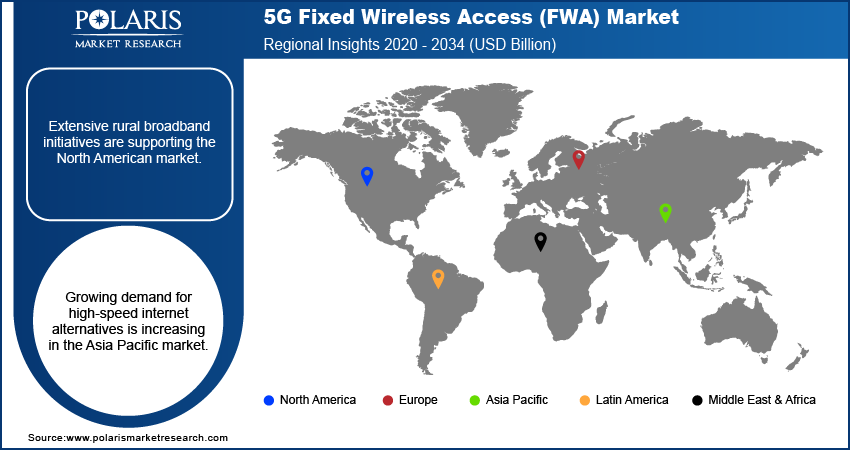

5G Fixed Wireless Access Market Breakdown by Regional Insights

By region, the study provides the market insights into North America, Europe, Asia Pacific, Latin America, Middle East & Africa. In 2023, the North America region dominated the 5G fixed wireless access market owing to the technological advancements and latest launches in 5G infrastructure, such as the installation of small cells, fiber-optic cables, and other network elements.

For instance, in June 2023, Nokia introduced a high-gain 5G fixed wireless access receiver designed for North American operators. The receiver is compatible with a wide variety of 5G and 4G bands, such as CBRS in both 5G and 4G, along with C-band.

The North American government is also backing the implementation of 5G technology through different programs and policies designed to enhance network infrastructure.

For instance, in October 2020, the U.S. Federal Communications Commission created the 5G Fund for Rural America, aimed at providing $9 billion to operators from the Universal Service Fund for the deployment of advanced 5G mobile wireless services in rural areas of the country.

Global 5G Fixed Wireless Access Market, Regional Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

The Asia Pacific 5G fixed wireless access market is expected to grow at the fastest CAGR from 2024 to 2032. This is due to the expanding population and increasing uptake of 5G technology.

The rising demand for e-commerce and digital services such as streaming services, online gaming, and social media has led operators to offer high-speed internet with 5G fixed wireless access technology to meet the increasing demand from consumers.

Market players are also focusing on the development of novel technologies to cater to the mass population and to serve better offerings in the Asia Pacific region, further driving the market during the forecast period.

For instance, in December 2023, HFCL Ltd. launched the 5G fixed wireless access and Customer Premise Equipment (CPE) solutions in India. The company developed 5G FWA devices indigenously to offer fiber optic-like connections through 5G wireless networks in order to address the lack of broadband in certain areas.

5G Fixed Wireless Access Key Market – Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the 5G fixed wireless access market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, 5G fixed wireless access industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global 5G fixed wireless access industry to benefit clients and increase the market sector. In recent years, the 5G fixed wireless access industry has offered some technological advancements. Major players in the 5G fixed wireless access market include CommScope; Ericsson; Huawei Technologies Co., Ltd.; Inseego Corp.; Intel Corporation; MediaTek Inc.; Qualcomm Technologies Inc.; Samsung; Verizon Communications Inc.; and Vodafone.

Ericsson is a provider of telecommunications equipment and services, offering a comprehensive portfolio of products and services in the areas of mobility, broadband, and cloud. The company's offerings include network infrastructure for mobile and fixed communication, such as 4G, 3G, and 5G radio networks, and IP core and transport networks. Ericsson has a global presence in Europe, North America, Asia Pacific, Latin America, Africa, and the Middle East. In October 2022, Ericsson collaborated with Jio to construct the initial 5G Standalone network in India. Ericsson implemented its 5G RAN products and solutions, E-band microwave mobile transport solutions, to support Jio in offering FWA services to consumers.

Samsung is a manufacturer for consumer electronics, with its extensive product portfolio spanning multiple categories. The company's offerings encompass a wide array of cutting-edge technologies, including smartphones, tablets, wearables, home appliances, televisions, audio devices, smart switch, sound devices, refrigerators, laundry, air solutions, cooking appliances, monitors, memory storage, and semiconductors. Samsung's flagship Galaxy series remains at the forefront of the smartphone market, boasting innovative features and powerful performance. In January 2021, Samsung launched the 5G vRAN 2.0 solutions. This development enabled the establishment of more adaptable networks for customers utilizing a wide range of advanced wireless services and applications.

List of Key Companies in the 5G Fixed Wireless Access Market

- CommScope

- Ericsson

- Huawei Technologies Co., Ltd.

- Inseego Corp.

- Intel Corporation

- MediaTek Inc.

- Qualcomm Technologies Inc.

- Samsung

- Verizon Communications Inc.

- Vodafone

5G Fixed Wireless Access Industry Developments

November 2022: Vodafone introduced the 5G FWA services for residences and enterprises in Spain. This 5G infrastructure covered 1,000 towns in Spain, providing coverage to 46 percent of the population.

October 2022: Verizon expanded its Verizon Forward Program by introducing 5G Home and LTE Home FWA services, making them available to customers across the country through its LTE and 5G wireless network.

October 2022: Singtel collaborated with Ericsson to implement the Ericsson AIR 3268 into its 5G infrastructure as part of achieving net-zero emissions. This collaboration expanded Singtel’s 5G FWA coverage.

5G Fixed Wireless Access Market Segmentation

5G Fixed Wireless Access – Offering Outlook

- Hardware

- Access Units

- Pico Cells

- Femto Cells

- Customer Premises Equipment (CPE)

- Outdoor CPE

- Indoor CPE

- Services

5G Fixed Wireless Access – Frequency Outlook

- Above 39 GHz

- Sub-6 GHz

- 24-39 GHz

5G Fixed Wireless Access – Demography Outlook

- Rural

- Semi-Urban

- Urban

5G Fixed Wireless Access – Application Outlook

- Government

- Commercial

- Residential

- Industrial

- Oil & Gas

- Utility

- Mining

- Others

5G Fixed Wireless Access – Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

5G Fixed Wireless Access Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 36.80 billion |

|

Market Size Value in 2024 |

USD 51.05 billion |

|

Revenue Forecast in 2032 |

USD 712.85 billion |

|

CAGR |

39.0% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global 5G fixed wireless access market size was valued at USD 36.80 billion in 2023 and is projected to be valued at USD 712.85 billion in 2032.

The global market is projected to grow at a CAGR of 39.0% during the forecast period, 2024-2032.

North America held the largest share of the global market.

The key players in the market are CommScope; Ericsson; Huawei Technologies Co.; Ltd.; Inseego Corp.; Intel Corporation; MediaTek Inc.; Qualcomm Technologies Inc.; Samsung; Verizon Communications Inc.; and Vodafone.

The services category dominated the 5G fixed wireless access market in 2023.

The residential category held the largest share in the 5G fixed wireless access market.