3D Printing Elastomers Market Share, Size, Trends, Industry Analysis Report, By Type (Thermoplastic Elastomers, Thermoset Elastomers); By Form; By End-Use; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 118

- Format: PDF

- Report ID: PM2004

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

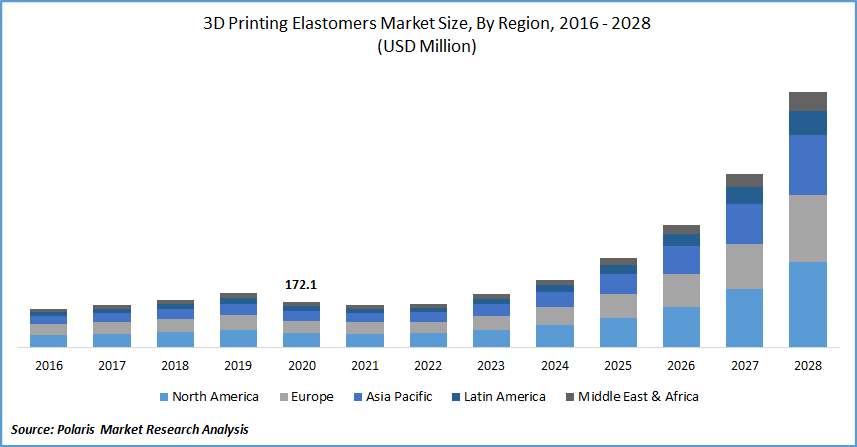

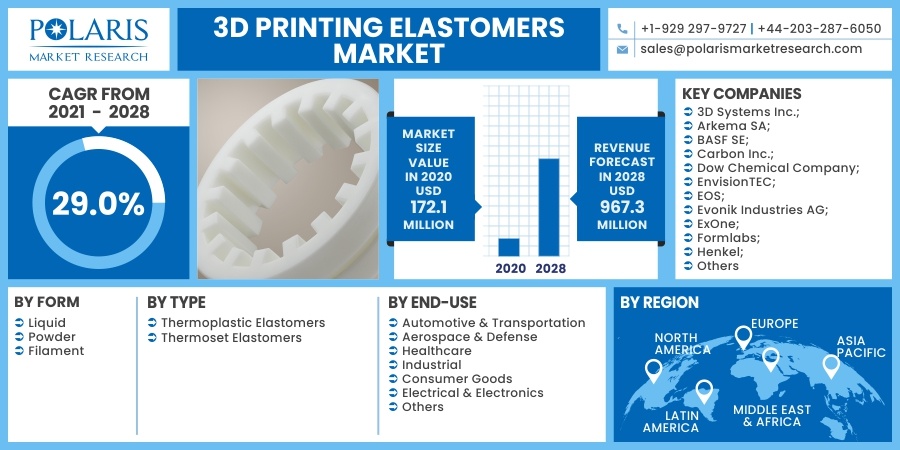

The global 3D printing elastomers market size was valued at USD 172.1 million in 2020 and is anticipated to grow at a CAGR of 29.0% during the forecast period. The demand for elastomers such as thermoplastic polyurethane, thermoplastic vulcanizate, styrene-butadiene rubber, and silicone has increased for 3D printing over the years.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

These elastomers offer properties such as high tear and abrasion resistance, durability, and elasticity. 3D printing technology uses elastomers to manufacture various prototypes, spare parts, and functional parts across multiple industries such as aerospace, automobile, defense, medical, and industrial.

Rising industrialization and increasing commercial activities across the globe drive the market growth for 3D printing elastomers. Greater requirement for remote production, weight reduction, high speed, and mass customization for manufacturing has increased the demand for elastomers.

The application of 3D printing elastomers has increased in the healthcare and automotive sectors owing to increased demand for complex designs and superior precision. Growing investment in R&D, technological advancements, and application in diverse industries are driving the market growth for 3D printing elastomers.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increasing adoption of home 3D printers, growing need to manufacture lightweight designs, enhanced efficiency in the use of raw materials, improved freedom of design, reduced production time, and freedom of customization are some factors boosting the market growth.

Thermoplastic vulcanizate is an elastomer that offers benefits such as durability, manufacturing flexibility, and ease of processing. It is used in industrial, automotive, and consumer applications for its superior performance, reduced weight, lower costs, and recyclability compared to other materials.

Products manufactured with thermoplastic vulcanizates are flexible, strong, and display excellent aesthetics. They are easy to process and provide more sustainable manufacturing. The economic growth in countries such as China, Japan, and India and growing demand from emerging economies supplement the market growth. Global players are expanding into these countries to tap market potential.

The demand for 3D printing elastomers has increased during the pandemic to address the supply-demand imbalances caused by the shortage of raw materials and disruptions in supply chains. There has been a significant need for personal accessories, PPE kits, medical and testing devices, training and visualization aids, and emergency dwellings during the pandemic.

The digital versatility and quick prototyping of 3D printing are being used to respond to the emergency needs of the healthcare sector. Market players are developing 3D printed mask connectors, nasopharyngeal swabs for improved testing, personalized 3D-printed face masks, among other equipment to support the healthcare sector.

However, the demand from the automotive, aerospace & defense, and consumer goods sectors has reduced during the pandemic owing to operational challenges, transportation delays, and travel restrictions. The market has experienced workforce impairment and a decline in manufacturing activities. Restrictions on imports of goods to curb the spread of the virus have further contributed to restricting the market growth.

Report Segmentation

The market is primarily segmented on the basis of form, type, end-use, and region.

|

By Form |

By Type |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Form Outlook

Based on form, the printing polymers market is segmented into liquid, powder, and filament. In 2020, the powder segment accounted for the highest market share and was expected to continue its dominance over the forecast period. Elastomer powders are used to develop complex structures, advanced design possibilities, customized structures, and high-density products.

Type Outlook

The type segment has been divided into thermoplastic and thermoset. The thermoplastic printing polymers segment accounted for a significant share in 2020. The thermoplastic segment is further divided into thermoplastic polyurethane, thermoplastic vulcanizate, styrene block copolymers, and thermoplastic polyolefin.

Thermoplastic polyurethane offers properties such as elasticity, thermal stability, high tear & abrasion resistance, and high elongation at break. It is also resistant to greases, oils, and other solvents. It is widely used in automotive and consumer goods owing to its durability and ability to produce high-quality printing products.

End-Use Outlook

On the basis of the end-use, the printing elastomers market is segmented into automotive and transportation, aerospace and defense, healthcare, industrial, consumer goods, electrical and electronics, and others. The automotive segment dominated the global 3D printing elastomers market in 2020. 3D printing elastomers are used in the manufacturing of high-performing vehicles with lightweight and greater efficiency. 3D printing elastomers are used to produce automotive components with complex designs at a faster rate and greater design flexibility.

Regional Outlook

Asia Pacific printing elastomers are expected to grow at a significant rate during the forecast period. Increasing urbanization, growing consumer goods industry, expansion of international players in this region, and technological advancements are some factors attributed to the growth in this region.

The industrial development in countries such as China, India, and Japan, rising automotive penetration, and the established electronics industry drive this region's growth. Increasing applications in the aerospace, defense and healthcare sectors have further increased the region's demand for 3D printing polymers.

Competitive Landscape

The leading players in the 3D printing elastomers market include 3D Systems Inc.; Arkema SA; BASF SE; Carbon Inc.; Dow Chemical Company; EnvisionTEC; EOS; Evonik Industries AG; ExOne; Formlabs; Henkel; HP Development Company, L.P.; Impossible Objects; LANXESS; Materialise NV; Proto Labs Inc.; Sinterit; Stratasys Ltd.; The Lubrizol Corporation; Voxeljet AG; and Zortrax.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products in the market for 3D printing polymers to cater to the growing consumer demands.

3D Printing Elastomers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 172.1 million |

|

Revenue forecast in 2028 |

USD 967.3 million |

|

CAGR |

29.0% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Segments covered |

By Form, By Type, By End-use, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key companies |

3D Systems Inc.; Arkema SA; BASF SE; Carbon Inc.; Dow Chemical Company; EnvisionTEC; EOS; Evonik Industries AG; ExOne; Formlabs; Henkel; HP Development Company, L.P.; Impossible Objects; LANXESS; Materialise NV; Proto Labs Inc.; Sinterit; Stratasys Ltd.; The Lubrizol Corporation; Voxeljet AG; and Zortrax. |