3D Digital Asset Market Size, Share, Trends, Industry Analysis Report: By Component, Application, Deployment (On-Premise and Cloud), Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5210

- Base Year: 2024

- Historical Data: 2020-2023

3D Digital Asset Market Overview

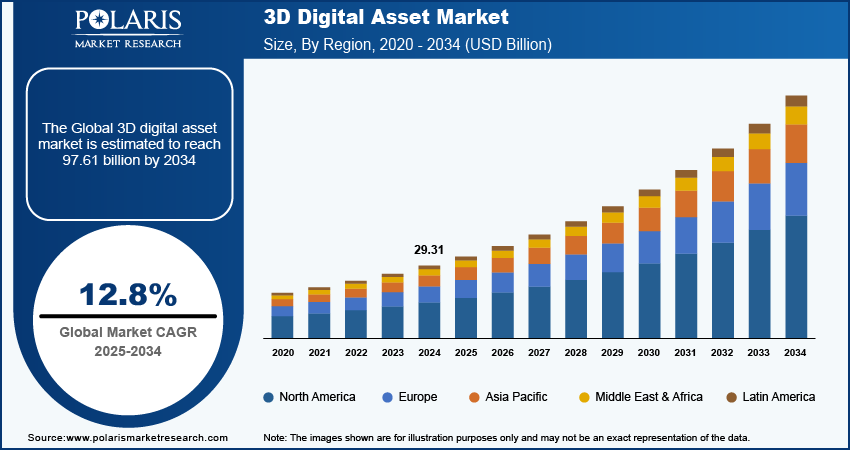

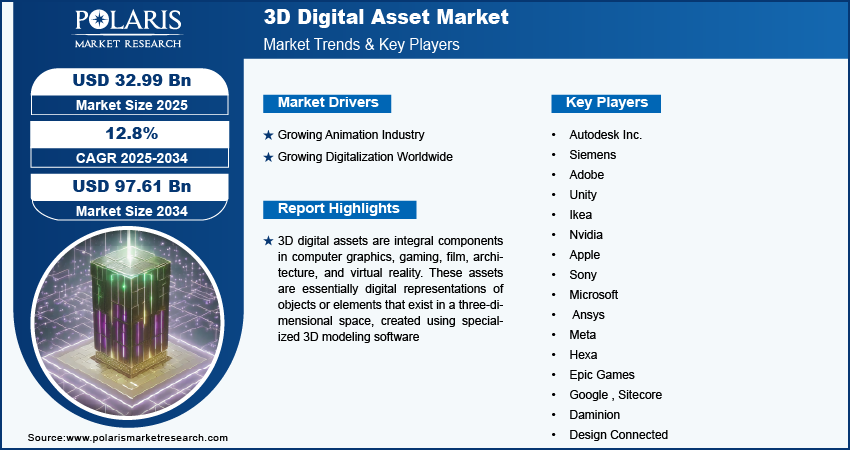

The 3D digital asset market size was valued at USD 29.31 billion in 2024. The market is projected to grow from USD 32.99 billion in 2025 to USD 97.61 billion by 2034, exhibiting a CAGR of 12.8% from 2025 to 2034.

3D digital assets are integral components in computer graphics, gaming, film, architecture, and virtual reality. These assets are essentially digital representations of objects or elements that exist in a three-dimensional space, created using specialized 3D modeling software. They encapsulate data defining the shape, texture, and appearance of objects, allowing them to be animated in various applications.

3D digital assets are being increasingly used by businesses to elevate customer experiences, drive engagement, and attract a larger customer base. The growing demand for 3D models to enhance product visualization is a key factor boosting market growth.

To Understand More About this Research: Request a Free Sample Report

3D gaming models are continually evolving to improve visual quality and create immersive environments, offering gamers more realistic gameplay experiences. 3D assets are used to develop various elements of gaming, including audio, lighting, visuals, background environment, buildings, structures, and other features that engage and captivate gamers. In addition, there is a growing demand for AI-integrated models within the gaming industry, which is a prominent trend expected to drive 3D digital asset market growth. For instance, in March 2024, Valeo introduced Valeo Racer, a reality game developed with Advanced Driving Assistance Systems that incorporates cameras, radar, ultrasonic sensors, and artificial intelligence perception algorithms to simulate the car's real-time environment.

3D Digital Asset Market Trends and Driver Analysis

Growing Animation Industry

Animation studios are investing more in sophisticated 3D assets to achieve cinematic visuals that attract viewers, whether in animated films, commercials, or video games. Moreover, with more animation studios, there’s a greater need for 3D assets to support complex animations, from character models and environmental assets to special effects. Hence, as the demand animation industry evolves, the demand for 3D digital assets also spurs.

Growing Digitalization Worldwide

The rising digitalization has increased the number of e-commerce platforms that foster innovations to enhance the efficiency of business operations and customer optimization. These platforms are integrating artificial intelligence technologies, including 3D digital asset management, to develop more feature-rich and innovative applications that include three-dimensional product models, to attract a broader range of consumers, thereby propelling the market. For instance, IKEA has created The Place App, which uses 3D Digital assets to enable customers to position furniture items within their homes via their smartphone cameras. This allows them to accurately envision how the item will appear within their home settings.

3D Digital Asset Market Segment Analysis

3D Digital Asset Market Breakdown by Deployment Insights

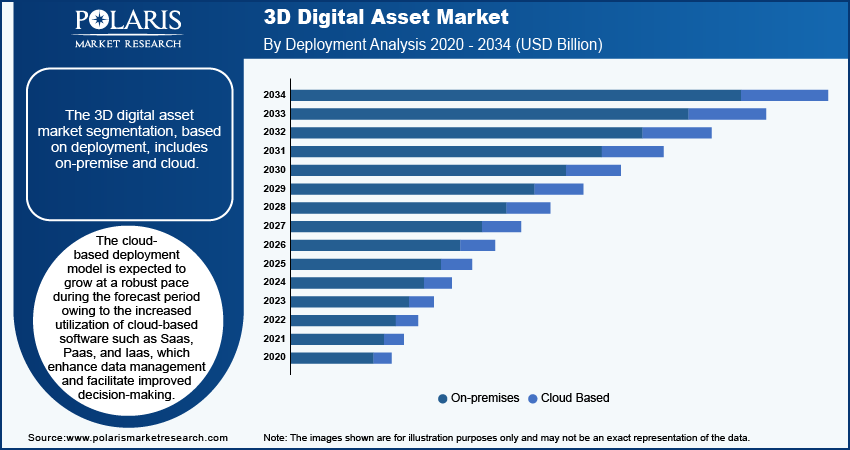

The 3D digital asset market segmentation, based on deployment, includes on-premise and cloud. The cloud-based deployment model is expected to grow at a robust pace during the forecast period owing to the increased utilization of cloud-based software such as Saas, Paas, and Iaas, which enhance data management and facilitate improved decision-making. In addition, cloud-based 3D digital asset management solutions reduce costs associated with maintenance. These solutions are accessible to every user in a company, including external shareholders, helping to maintain transparency and acting as a key factor in boosting market growth. The growing reliance on the internet is further driving up the need for cloud solutions that are accessible online from any location.

3D Digital Asset Market Breakdown by Vertical Insights

The 3D digital asset market segmentation, based on vertical, includes architecture & construction, media & entertainment, manufacturing, healthcare & life science, retail & e-commerce, automotive, government & public sector, and others. The automotive segment is expected to register the fastest CAGR from 2025 to 2034 due to the increased adoption of 3D digital assets for vehicle design and manufacturing. 3D assets, including computer-aided design (CAD) software codes and others, are integral in providing technical schematics, diagrams, and programming code for operating brakes and other electronic systems. Moreover, the surge in digital visualizations and simulations is further propelling the demand for 3D digital assets in the automotive segment.

3D Digital Asset Market Breakdown by Regional Insights

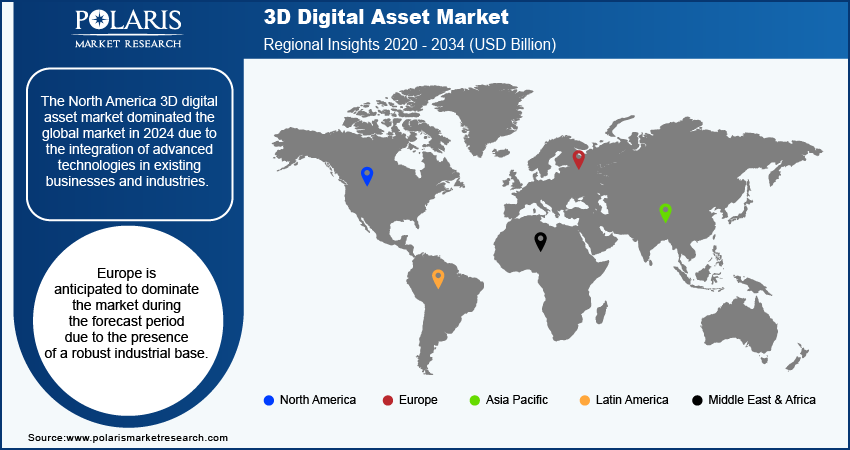

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America 3D digital asset market dominated the global market in 2024 due to the integration of advanced technologies in existing businesses that foster innovations and enhance business operations. In addition, the presence of major companies such as Autodesk, Adobe and Unity offering their services further strengthens the market landscape in North America.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

Canada dominates the market with the largest share due to the widespread adoption of automated and advanced technologies by businesses across the country. Additionally, the increasing number of startups and companies are driving digitalization efforts to improve the overall customer experience, which is estimated to fuel the demand for 3D digital assets. Moreover, the presence of both homegrown Canadian market vendors, such as MediaValet and CleanPix, as well as global market vendors, has played a pivotal role in intensifying and sustaining the market's expansion in Canada.

Europe is anticipated to dominate the market during the forecast period due to the presence of a robust industrial base. Key sectors such as automotive, aerospace, and manufacturing are progressively integrating 3D assets into their processes for product design, prototyping, and marketing. Additionally, businesses are widely leveraging rapid technological advancements such as 3D scanning and modeling to improve operational efficiency and enhance customer experience. Furthermore, governments are making significant investments in digitization to encourage individuals to adopt technological advancements, which is fueling the 3D digital asset market in the region. For instance, in 2023, the European Commission launched Twin It (3D for Europe Culture), which aims to digitalize the cultural heritage assets of Europe.

3D Digital Asset Market – Key Players & Competitive Insights

Major market players are investing heavily in research and development in order to expand their product base, which will help the 3D digital asset market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, 3D digital asset companies must offer innovative solutions.

In recent years, the 3D digital market has witnessed several technological advancements. Major players in the 3D digital asset market include Autodesk Inc., Siemens, Adobe, Unity, IKEA, NVIDIA, Apple, Sony, Microsoft, Ansys, Meta, Hexa, EpicGames, Google, Hexa, Sitecore, Daminion, and Design Connected.

Autodesk is a software company renowned for its innovative software solutions and services tailored for a diverse range of industries including architecture, engineering, construction, manufacturing, media, and entertainment. The company's product portfolio encompasses AutoCAD, a powerful tool for both 2D and 3D computer-aided design (CAD); Revit, a sophisticated platform for building information modeling (BIM); Maya, an industry-leading software for 3D animation, and Fusion 360, an advanced solution designed for product design and production.

Adobe, a US-based company, is a global player in the 3D digital asset market. The company's Adobe Creative Cloud has a comprehensive suite of powerful tools, including Adobe Substance 3D, which delivers advanced solutions for 3D asset creation, texturing, and rendering. The tools are widely utilized by designers, game developers, and visual effects artists to produce top-tier, lifelike 3D models and environments. Adobe's innovation and the incorporation of AI-driven features significantly enhance the creation and manipulation of 3D content, further driving market growth.

List of Key Companies in 3D Digital Asset Industry Outlook

- Autodesk Inc.

- Siemens

- Adobe

- Unity

- Ikea

- Nvidia

- Apple

- Sony

- Microsoft

- Ansys

- Meta

- Hexa

- Epic Games

- Sitecore

- Daminion

- Design Connected

3D Digital Asset Industry Developments

June 2024: Siemens collaborated with Intel Foundry to develop Electronic Design Automation (EDA) product certification and innovate 3D-IC (3D integrated circuit) to provide customers with advanced technology to enhance operational efficiency.

March 2024: NVIDIA announced the launch of NVIDIA AI Enterprise-IGX software, along with NVIDIA Holoscan, for use on the NVIDIA IGX platform. The new platform aims to assist providers in the medical, industrial, and scientific computing fields in creating and implementing edge AI solutions more quickly, with top-notch software and support.

December 2023: Adobe introduced the Adobe Experience Platform (AEP) AI Assistant, which aims to enable brands to automate tasks, model potential outcomes, and create new target audiences and customer journeys.

3D Digital Asset Market Segmentation

By Component Outlook (Revenue, USD Billion; 2020–2034)

- Hardware

- 3D Scanners

- Motion Capture Systems

- Software

- 3D Modelling

- 3D Scanning Software

- 3D Animation Software

- 3D Rendering & Visualization Software

- Image Reconstruction Software

- Services

- Professional Service

- Managed Service

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Visualization

- Simulation

- Digital Prototyping

- Gaming & Animation

- Virtual Experience

- Marketing & Advertising

- Other

By Deployment Outlook (Revenue, USD Billion; 2020–2034)

- On-premise

- Cloud

By Vertical Outlook (Revenue, USD Billion; 2020–2034)

- Architecture & Construction

- Media & Entertainment

- Manufacturing

- Healthcare & Lifescience

- Retail & E-commerce

- Automotive

- Government & Public Sector

- Other

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

3D Digital Asset Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 29.31 billion |

|

Market Size Value in 2025 |

USD 32.99 billion |

|

Revenue Forecast in 2034 |

USD 97.61 billion |

|

CAGR |

12.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The 3D digital asset market size was valued at USD 29.31 billion in 2024 and is projected to grow to USD 97.61 billion by 2034.

The market is projected to grow at a CAGR of 12.8% from 2025 to 2034.

North America had the largest share of the global market in 2024.

The key players in the market are Autodesk Inc., Siemens, Adobe, Unity, Ikea, Nvidia, Apple, Sony, Microsoft, Ansys, Meta, Epic Games, Google, Hexa, Sitecore, Daminion, and Design Connected.

The cloud deployment model is anticipated to dominate the market in the coming years.

The architecture & construction segment had the largest share of the global market in 2024.