2-Ethylhexanol Market Size, Share, Trends, Industry Analysis Report: By Application, End Use (Paint and Coatings, Adhesives, Industrial Chemicals, and Other), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 125

- Format: PDF

- Report ID: PM5180

- Base Year: 2024

- Historical Data: 2020-2023

2-Ethylhexanol Market Overview

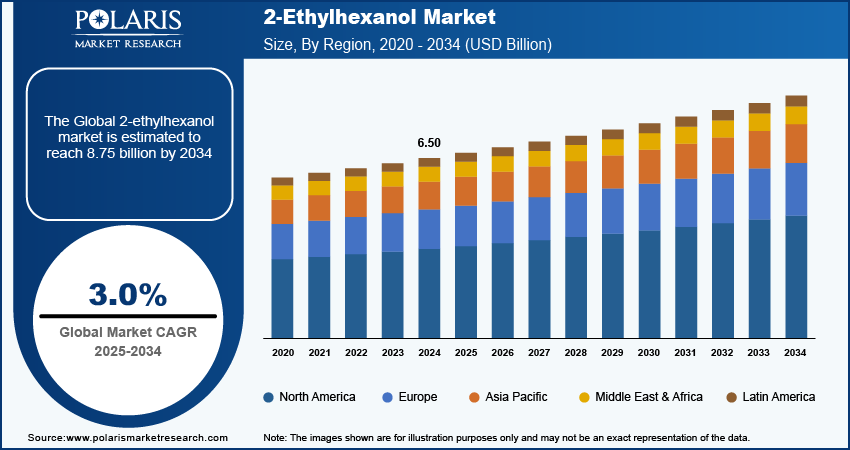

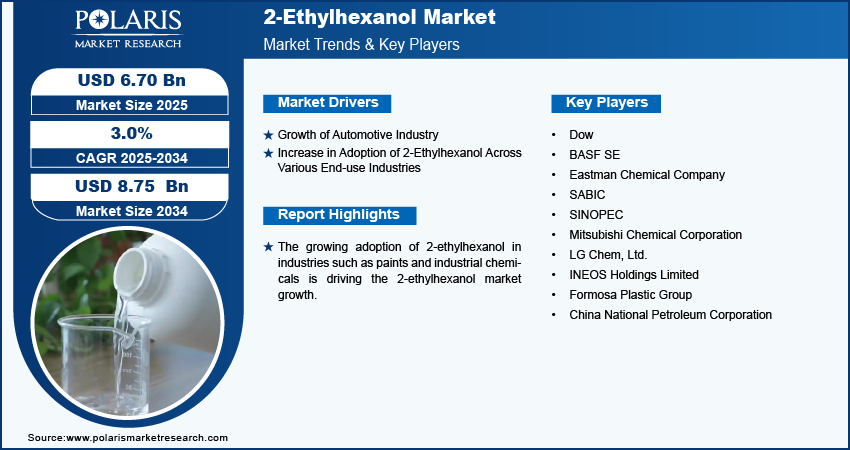

The 2-ethylhexanol market size was valued at USD 6.50 billion in 2024. The market is projected to grow from USD 6.70 billion in 2025 to USD 8.75 billion by 2034, exhibiting a CAGR of 3.0% during the forecast period.

2-Ethylhexanol is a branched-chain fatty alcohol primarily used as a chemical intermediate in the production of plasticizers, lubricants, and fuel additives. Its versatility and effectiveness make it essential in various industrial applications, such as automotive and metalworking sectors.

The growing demand for plasticizers in the construction and automotive industries is driving the 2-ethylhexanol market growth. Plasticizers, which are added to plastics to enhance their flexibility and performance, rely heavily on 2-ethylhexanol as a key ingredient Furthermore, the increasing use of polyvinyl chloride (PVC) in a wide range of applications, from flooring to wiring is propelling the demand for 2-ethylhexanol.

To Understand More About this Research: Request a Free Sample Report

The 2-ethylhexanol market is expected to grow significantly during the forecast period due to increasing regulatory support for green chemicals. Governments across the world are imposing stricter environmental regulations that encourage industries to adopt sustainable practices. This shift is pushing manufacturers to seek out eco-friendly alternatives, including renewable forms of 2-ethylhexanol. As companies strive to comply with these regulations and meet consumer demands for greener products, the demand for 2-ethylhexanol is likely to rise in the coming years.

2-Ethylhexanol Market Driver Analysis

Growth of Automotive Industry

Automotive manufacturers are seeking to enhance the performance and efficiency of their products. 2-ethylhexanol is used in automotive manufacturing for various applications, including lubricant additives and fuel additives. According to the International Organization of Motor Vehicle Manufacturers, in 2023, global vehicle sales increased by 12% compared to 2022, reflecting the growth of the automotive industry. With the automotive industry's growth, the demand for 2-ethylhexanol continues to rise, driving growth in the 2-ethylhexanol market.

Increase in Adoption of 2-Ethylhexanol Across Various End-use Industries

2-ethylhexanol is used in multiple end-use industries, such as paints and industrial chemicals. In the paints industry, it is used as a solvent, helping to improve the texture and application of paints, leading to a smoother finish. Similarly, industrial chemicals act as a key ingredient in various formulations, enhancing product performance. More manufacturers are recognizing the benefits of using 2-ethylhexanol in their products, due to which the demand continues to rise. Thus, the broader acceptance of 2-ethylhexanol across diverse industries boosts the 2-ethylhexanol market growth.

2-Ethylhexanol Market Segment Analysis

2-Ethylhexanol Market Breakdown by Application Outlook

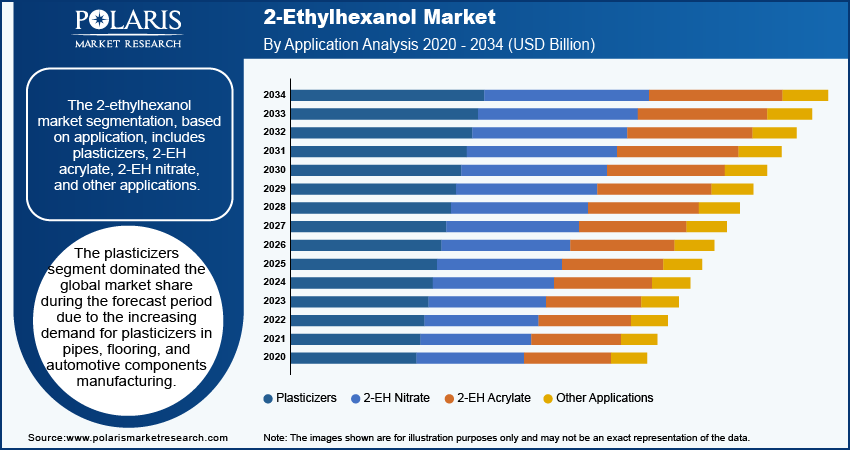

The 2-ethylhexanol market segmentation, based on application, includes plasticizers, 2-EH acrylate, 2-EH nitrate, and other applications. The plasticizers segment experienced the highest CAGR in the global market in 2024. This growth is attributed to the increasing demand for plasticizers in pipes, flooring, and automotive manufacturing. Plasticizers made from 2-ethylhexanol play a crucial role in improving the performance of materials durable and flexible products, such as PVC which are widely adopted by industries. Additionally, the demand for effective plasticizers is estimated to continue to rise with the expansion of the construction and automotive sectors.

2-Ethylhexanol Market Breakdown by End Use Outlook

The 2-ethylhexanol market segmentation, based on end use, includes paint and coatings, adhesives, industrial chemicals, and others. The industrial chemical segment dominated the market in 2024 due to its importance across various applications, such as coatings, adhesives, and surfactants, where 2-ethylhexanol serves as a key ingredient. Its unique properties, such as enhancing flexibility and performance, make it highly valuable for manufacturers. Additionally, the continuous expansion of coating and surfactant industries has increased the demand for 2-ethylhexanol. Therefore, the importance of 2-ethylhexanol in coating, adhesives, and surfactants is a key factor leading to segmental dominance.

2-Ethylhexanol Market Breakdown by Regional Outlook

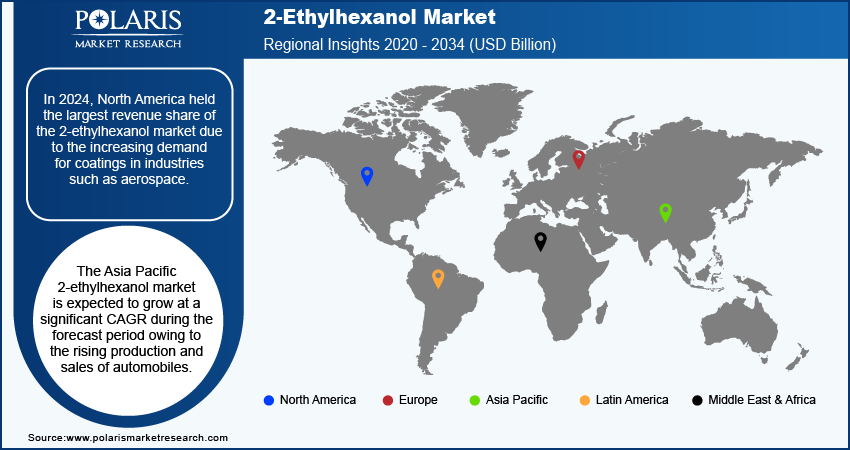

By region, the study provides the 2-ethylhexanol market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share due to the increasing demand for coatings in industries such as aerospace. Aerospace is one of the largest industries in North America. According to the US Aerospace Industry Association, in 2020, this industry accounted for 1.4% of all employment in the US. The expansion of this industry has significantly increased the need for high-quality coatings that protect and enhance aircraft performance, thereby increasing demand for 2-ethylhexanol.

The Asia Pacific 2-ethylhexanol market is experiencing significant growth due to rapid industrialization. Countries such as China and Taiwan continue to expand their manufacturing sectors, which has raised the demand for chemicals, including 2-ethylhexanol. This chemical is essential for producing plastics, coatings, and adhesives, all of which are in high demand as industries develop. The region focuses on improving production capabilities and modernizing infrastructure, which drives the demand for 2-ethylhexanol across Asia Pacific.

India is witnessing a substantial growth of the automotive industry. According to the International Organization of Motor Vehicle Manufacturers, automotive sales in India rose by 7% from 2022 to 2023, reflecting strong growth in the industry. This growth of the industry is driving the demand for 2-ethylhexanol as it is used in the manufacturing of lubricants, fuel additives, and coatings used in automotive applications.

2-Ethylhexanol Market – Key Players and Competitive Insights

The 2-ethylhexanol market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development and advanced techniques. These companies adopt strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative formulations to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the 2-ethylhexanol market are Dow; BASF SE; Eastman Chemical Company; SABIC; SINOPEC; Mitsubishi Chemical Corporation; LG Chem, Ltd.; INEOS Holdings Limited; Formosa Plastic Group; and China National Petroleum Corporation.

BASF SE is a global chemical corporation with seven distinct business segments, including chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. Surface technologies provide chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. The nutrition and care sector provides ingredients for food and feed producers, pharmaceutical, detergent, cosmetics, and cleaner industries. Lastly, the agricultural solutions segment offers seeds and crop protection products, such as herbicides, fungicides, insecticides, seed treatment products, and biological crop protection products.

Mitsubishi Chemical Group Corporation, a chemical manufacturing company, works in five segments: healthcare, specialty materials, industrial gases, MMA, and basic materials. The industrial gases segment supplies various industrial gases, while the healthcare segment concentrates on delivering ethical pharmaceuticals. The specialty materials segment offers a wide range of products, including performance polymers, engineering plastics, sustainable polymers, and composite materials. The MMA segment specializes in providing polymethyl methacrylate and methyl methacrylate. The basic materials component offers polyolefins, basic petrochemicals, and carbon products. Additionally, the company provides engineering, transportation, and warehousing services. The product is applicable in various industries, including petrochemicals, intermediates, automotive and aircraft, machinery and equipment, electronics and IT, packaging, label and printing, logistics, civil engineering, building and construction, plant energy, daily goods, leisure and sports, medical and health care, agriculture, food, software, knowledge and service, and clothing.

Key Companies in the 2-Ethylhexanol Industry Outlook

- Dow

- BASF SE

- Eastman Chemical Company

- SABIC

- SINOPEC

- Mitsubishi Chemical Corporation

- LG Chem, Ltd.

- INEOS Holdings Limited

- Formosa Plastic Group

- China National Petroleum Corporation

2-Ethylhexanol Market Industry Developments

August 2024: BASF signed a Memorandum of Understanding (MoU) with UPC Technology Corporation, focusing on the supply of 2-ethylhexanol and n-butanol. This partnership aimed to enhance cooperation in sustainable solutions for plasticizer alcohols and catalysts.

October 2023: Perstorp's 2-EH Pro 100 was launched as a 100% renewable variant of 2-ethylhexanol, featuring a negative carbon footprint. The product was certified ISCC PLUS, promoting sustainable sourcing and traceability in the chemical industry and supporting a transition toward eco-friendly solutions.

2-Ethylhexanol Market Segmentation

By Application Outlook (Volume, Kilo Tons, USD Billion, 2020–2034)

- Plasticizers

- 2-EH Acrylate

- 2-EH Nitrate

- Other Applications

By End Use Outlook (Volume, Kilo Tons, USD Billion, 2020–2034)

- Paint and Coatings

- Adhesives

- Industrial Chemicals

- Other

By Regional Outlook (Volume, Kilo Tons, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

2-Ethylhexanol Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.50 Billion |

|

Market Size Value in 2025 |

USD 6.70 Billion |

|

Revenue Forecast by 2034 |

USD 8.75 Billion |

|

CAGR |

3.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilo Tons, Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Volume Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The 2-ethylhexanol market size was valued at USD 6.50 billion in 2024 and is projected to grow to USD 8.75 billion by 2034.

The global market is projected to register a CAGR of 3.0% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are Dow; BASF SE; Eastman Chemical Company; SABIC; SINOPEC; Mitsubishi Chemical Corporation; LG Chem, Ltd.; INEOS Holdings Limited; Formosa Plastic Group; and China National Petroleum Corporation.

The plasticizers segment experienced a significant CAGR in the global market in 2024.

The industrial chemical segment dominated the market in 2024.