1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and Spandex Market Share, Size, Trends, Industry Analysis Report, By Form (Polybutylene terephthalate (PBT), Gamma-Butyrolactone (GBT), Tetrahydrofuran (THF), Polyurethane (PU), Others); By Application; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Aug-2022

- Pages: 112

- Format: PDF

- Report ID: PM1254

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

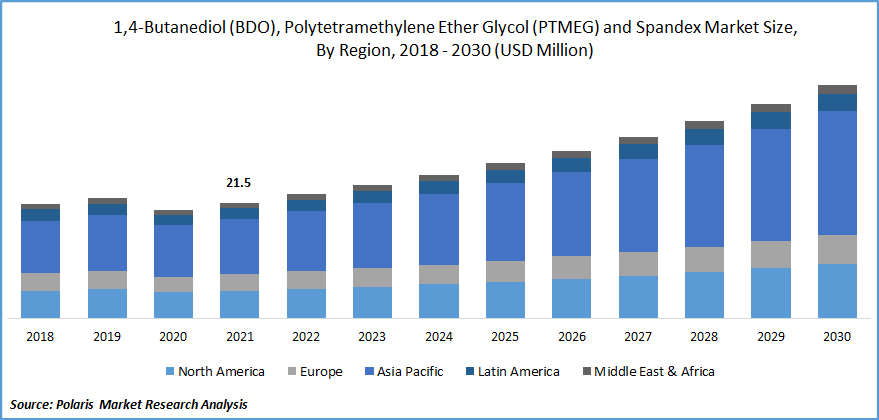

The global 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG), and spandex market was valued at USD 21.5 million in 2021 and is expected to grow at a CAGR of 8.2% during the forecast period. The market for 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) is being driven by a rising level of awareness about the advantages of these elevated engineering components that bridge the gap between flexible elastomers and stiff plastics.

Know more about this report: Request for sample pages

For specific applications such as building coatings, synthesized polyurethane fibers, security windows, and lamination sheets, several industry firms have also created high-performance Polytetramethylene Ether Glycol (PTMEG) products.

Polytetramethylene Ether Glycol (PTMEG), also known as 1,4-butanediol (BDO), is a black waxy substance that can soften in ketone, ethanol, and other substances as well as in chlorinated and volatile hydrocarbons. In contrast to ambient temperature, polyoxytetramethylene appears transparent when present at high temperatures. In the process of creating pharmaceuticals, 1,4-butanediol (BDO) is used extensively.

Factors influencing the 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG), and spandex market's expansion include changing lifestyles, an increase in disposable money, and an increase in the need for better quality stretch fabric in various applications.

The fact that thermoplastic polyurethane is made from the biodegradable polymer 1,4-butanediol (BDO) PTMEG is credited as another growing cause. Growth in the targeted market of 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) would also be aided by the surge in polyurethane use.

However, it is predicted that strict regulatory rules that prohibit the use of toxic and carcinogenic compounds, such as 1,4-butanediol, in the production of Polytetramethylene Ether Glycol (PTMEG), will restrain 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) market expansion. It is anticipated that unstable raw material prices and the availability of low-cost replacements will impede 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and spandex market expansion.

COVID-19 has disrupted almost every industry, but due to the safety purpose, the demand for face masks and gloves was in high demand, which has led to an increase in the demand for the product. Face mask demand has significantly risen worldwide as a result of the new Coronavirus abrupt introduction since spandex is a crucial component in the creation of face masks.

Consequently, the business is anticipated to grow significantly over the forecast period. The ear loops of the mask are mostly made of spandex. An increasing number of consumer apparel and accessory producers in China, where the majority of face mask production is produced, are anticipated to significantly expand the market of 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) throughout the projection period.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The 1,4-Butanediol (BDO) expansion is anticipated to be driven by increasing demands for stretch fabrics of higher quality across a range of textile applications. The textile sector is anticipated to diversify, modernize, and expand its capacity at a faster rate, all of which will benefit the spandex. Consumers' rising disposable income is boosting demand for a variety of textiles.

Additionally, a growing population base is accelerating the need for textiles, which is, in turn, accelerating the 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and spandex market expansion of spandex. For instance, according to the United Nations, the population across the world could increase to more than 8.5 billion people in 2030. Also, it is anticipated to reach 9.7 billion in 2050 and then peak at about 10.4 billion during the 2080s.

Nylon, cotton, polyols, and allied brands are still owned by INVISTA. This comprises the 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and spandex market-leading nylon 6,6 intermediates business of INVISTA, its expansive range of nylon polymers and fibers, and well-known brands such as CORDURA cloth, ANTRON carpet fibers, and STAINMASTER carpet fibers.

Tetrahydrofuran (THF), polytetramethylene ether glycol (PTMEG), and 1,4-butanediol (BDO) technologies are covered by INVISTA. Thus, the major player's focus on the expansion of the textiles portfolio is boosting the market growth of 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) over the forecast period.

Report Segmentation

The market is primarily segmented based on form, end-use, application, and region.

|

By Form |

By Application |

By End-Users |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Textile Industry is Expected to Witness the Fastest Growth

The market expansion of 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) is being augmented by the clothing and apparel sector's robust growth. Novel use of spandex in denim and rising demand for lingerie, athletics, compression gear, and other items are also predicted to boost the market growth of 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG).

Polytetramethylene Ether Glycol (PTMEG) is used to create high-quality polyurethanes with improved properties like resistance to hydrolysis and microorganisms, great performance at low temperatures, and strong resistance to physical wear.

Further, it is anticipated that rising demand would propel the development of textiles with greater stretch for a variety of textile applications. In June 2020, in conjunction with Kingpins24's virtual denim event, Hyosung introduced innovative creora 3D Max spandex. With the introduction of 3D Max spandex, Hyosung was able to give denim items dual performance characteristics that would last over time, including ultra-stretch and excellent recovery.

With the addition of extra elements like laser surgery and eco-friendly finishing, 3D Max jeans have a natural feeling and appearance. Thus, product launches based on the products in the textile industry are boosting the market growth of 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG).

Tetrahydrofuran (Thf) Accounted for the Highest Market Share in 2021

Due to the increased production of Polytetramethylene Ether Glycol (PTMEG), a polymer widely used to create urethane elastomers and fibers, the THF business has grown during the past few years. It is also a multipurpose solvent with a variety of uses, including in the production of printing inks, vinyl films, cellophane, commercial resins, and synthetic rubber. It serves as a PVC-type cleaner before joint formation and is only utilized in the manufacture of PVC-type concrete.

Spandex Application is Expected to Hold the Significant Revenue Share

The demand for spandex is anticipated to increase throughout the forecast period as a result of new medical uses for the material in the field of protective clothing and wound treatment. Due to the significant demand for the creation of stretchy sports apparel and fabrics, spandex is the most lucrative application sector for PTMEG. Due to their outstanding intrinsic qualities, such as high elasticity, durability, and more flexibility than rubber, these fibers are only employed in this manner.

The Demand in Asia-Pacific is Expected to Witness Significant Market Growth

Increased population, rising spending power, and developing end-user sectors are all predicted to contribute to the Asia Pacific region's 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and spandex markets' rapid expansion. A growing number of end-use industries and the accessibility of cheap labor are expected to keep the Asia Pacific from losing its market share. A significant consumer is thought to be China because of rising disposable income.

The Tetrahydrofuran (THF) applications industry held the biggest market share and it is anticipated that this dominance will last during the projected period. The cause for this is the region's growing R&D activities, accessibility of a highly qualified workforce, cutting-edge processing and implementation technologies, and established infrastructure.

Further, it is also expected that government programs in the North American region like the Manufacturing Extension Partnership (MEP), which provides personally tailored assistance to assist industries in increasing their productivity, economic sustainability, and technical capabilities, will make a significant contribution to the market growth of 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG).

Competitive Insight

Some of the major players operating in the global 1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG) and spandex market include Asahi Kasei Corp., Ashland Inc., BASF SE, Hyosung Corporation, INVISTA Corporation, Indorama Industries Ltd, Jiangsu Shaungliang Company Limited., Mitsui Chemicals, Inc., TK Chemical Corporation, The Dow Chemical Company, Toray Industries Incorporation, Taekwang Industrial Limited, Xiamen Lilong Spandex Corporation, and Zhejiang Huafon Spandex Company.

Recent Developments

- In June 2021, Cargill and HELM have formed a joint venture called Qore. The first advertising, renewable BDO facility in the United States will be built as part of the partnership, with a combined investment from both firms of $300M. The clothing, automotive, electronic, and packaging businesses can reduce their environmental impact with bio-based intermediate without compromising the performance of their goods or changing their current downstream manufacturing techniques.

1,4-Butanediol (BDO), Polytetramethylene Ether Glycol (PTMEG), and Spandex Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 21.5 million |

|

Revenue forecast in 2030 |

USD 43.4 million |

|

CAGR |

8.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Form, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Asahi Kasei Corp., Ashland Inc., BASF SE, Hyosung Corporation, INVISTA Corporation, Indorama Industries Ltd, Jiangsu Shaungliang Company Limited., Mitsui Chemicals, Inc., TK Chemical Corporation, The Dow Chemical Company, Toray Industries Incorporation, Taekwang Industrial Limited, Xiamen Lilong Spandex Corporation, and Zhejiang Huafon Spandex Company |