Eyewear Market Size, Share, Trends, Industry Analysis Report

By Product (Spectacles, Lenses, and Sunglasses), By Distribution Channel, By End User, and By Region – Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1020

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

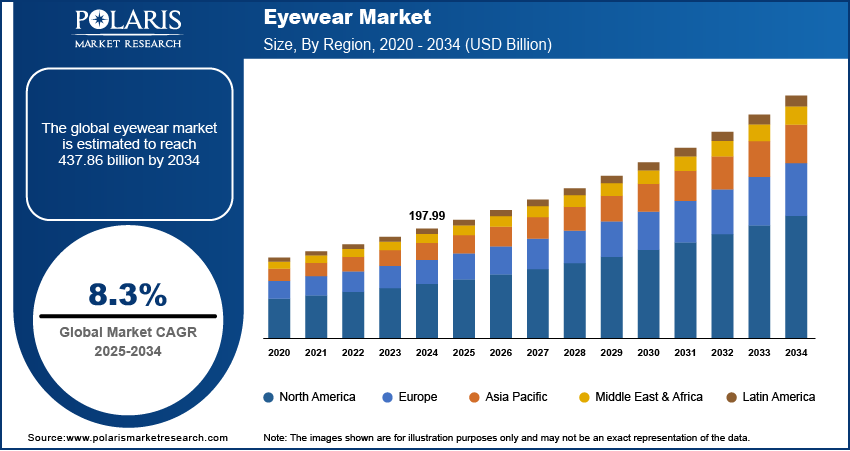

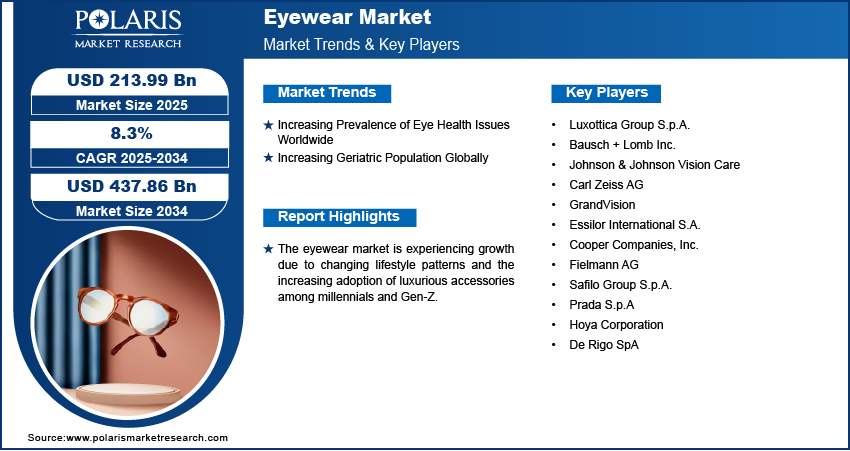

The eyewear market size was valued at USD 197.99 billion in 2024. It is expected to grow from USD 213.99 billion in 2025 to USD 437.86 billion by 2034, at a CAGR of 8.3% during 2025–2034. The market is growing steadily, driven by changing lifestyle trends, rising adoption of fashionable accessories among millennials and Gen Z, increasing vision problems, a growing elderly population, and expanding access to eye care and innovative digital tools.

Key Insights

- The spectacles segments accounted for largest market share in 2024.

- The retail store segment ruled the market share within the distribution and sales channel in 2024 because of consumer’s inclination towards in store buying because of the chance to experiment with frames turning to opticians and acquire instant fittings and adjustments.

- North America eyewear market held the largest market share in 2024 propelled by a robust concentration on regular eye examinations, and extensive reach to progressive healthcare services.

- The market in Asia Pacific is witnessing a notable CAGR in the coming years due to urbanization, growing disposable incomes and a concentration on vison care.

Industry Dynamics

- The growing existence of eye health problems fueled by the growing inclination towards corrective eyewear involving prescription glasses and contact lenses has become a priority for eye health issues such as myopia & presbyopia, hyperopia, and astigmatism.

- Growing geriatric population which is causing age related eye conditions, such as presbyopia, cataracts, age related macular degeneration, and glaucoma is pushing the market ahead.

- A notable opportunity is altering lifestyle motifs and growing acquisition of luxurious accessories amidst millennials and Gen Z.

- The restraining factor is the usage of contact lens is interim. Prolonged usage has side effects which is making consumers turn to LASIK.

Market Statistics

2024 Market Size: USD 197.99 billion

2034 Projected Market Size: USD 437.86 billion

CAGR (2025-2034): 8.3%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The market is experiencing growth due to changing lifestyle patterns and the increasing adoption of luxurious accessories among millennials and Gen Z. Eyewear encompasses a variety of products worn over the eyes for different purposes, primarily for vision correction and aesthetic appeal. The product includes glasses, sunglasses, contact lenses, and goggles. Eyewear also protects the eyes from harmful ultraviolet (UV) rays from the sun.

Eyewear makers are responding to this by focusing on developing attractive and affordable eyewear. The major players are making continuous efforts to acquire new customers and retain existing ones, which is positively impacting eyewear market statistics.

Market Dynamics

Increasing Prevalence of Eye Health Issues Worldwide

The increasing prevalence of eye health issues is propelling the eyewear market growth. According to the report published by the World Health Organization in August 2023, 2.2 billion people have near or distant vision impairment globally. Corrective eyewear, including prescription glasses and contact lenses, has become essential for a larger segment of the population as the prevalence of eye health issues, such as myopia & presbyopia, hyperopia, and astigmatism, is increasing globally. Moreover, growing awareness about eye health and the importance of regular eye check-ups encourages people to invest in high-quality eyewear, which boosts the revenue.

Increasing Geriatric Population Globally

The increasing geriatric population globally is supporting the eyewear market expansion. According to data published by the United Nations, the number of people aged 65 years or older worldwide is projected to more than double, rising from 761 million in 2021 to 1.6 billion in 2050. Older adults are more prone to age-related eye conditions, such as presbyopia, cataracts, age related macular degeneration, and glaucoma, which require corrective or protective eyewear to maintain visual clarity and eye health. Furthermore, the aging population's improved access to healthcare and growing awareness of preventive eye care encourage regular eye examinations and timely adoption of vision correction solutions such as spectacles and lenses.

Segment Insights

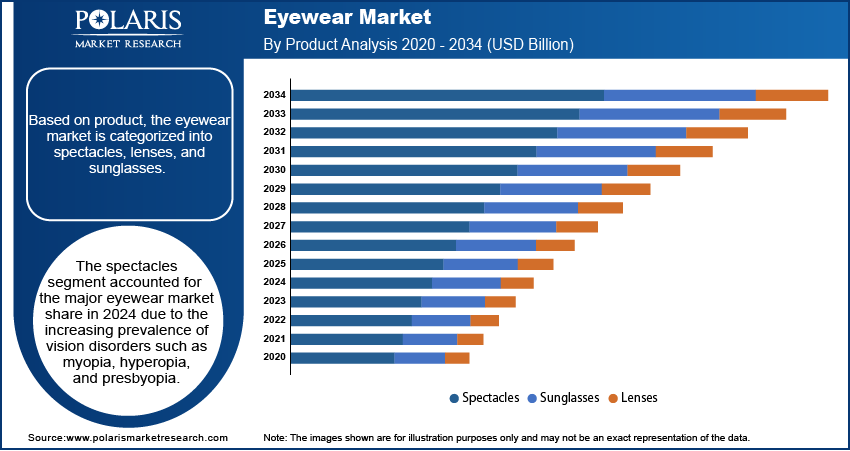

Assessment by Product Insights

Based on product, the market is categorized into spectacles, lenses, and sunglasses. The spectacles segment accounted for the major eyewear market share in 2024 due to the increasing prevalence of vision disorders such as myopia, hyperopia, and presbyopia. A surge in digital device usage across all age groups has worsened eye strain and vision problems, compelling more individuals to seek corrective solutions. Spectacles offer an accessible and customizable option, catering to diverse consumer needs with various lens types, coatings, and frames. Technological advancements, such as anti-glare and blue-light-blocking lenses, have further enhanced their appeal. Additionally, the growing trend of treating spectacles as a fashion accessory has spurred demand for stylish frames, especially among younger consumers. The spectacle's affordability compared to alternatives such as contact lenses or surgical interventions has also contributed to its dominance.

The lenses segment is expected to grow at a robust pace in the coming years, owing to the increasing preference for contact lenses among younger demographics who prioritize convenience, aesthetics, and active lifestyles. Advances in smart lens technology and the availability of specialized lenses designed for varied climatic and environmental conditions, such as UV-blocking or moisture-retaining options, further support this trend. Additionally, consumers in humid or high-dust locations often favor lenses over traditional frames due to comfort and practicality, contributing to the segmental growth.

Evaluation by Distribution Channel Insights

In terms of distribution channels, the eyewear market is divided into ophthalmic clinics, retail stores, and online stores. The retail stores segment dominated the market share within the distribution or sales channel in 2024. Consumers prefer in-store purchases due to the opportunity to try on frames, consult directly with opticians, and receive immediate fittings and adjustments. Retail outlets, especially those located in urban centers and shopping districts, also benefited from strong foot traffic and personalized services. The ability to offer a wide range of brands, price points, and promotional packages helped traditional retailers maintain their competitive edge. Many chains also integrated in-store optometry services, making them a convenient one-stop solution for vision care.

The online stores segment is expected to grow at the fastest pace during the assessment period, owing to technological advancements and shifting consumer preferences toward e-commerce. The rise of virtual try-on tools and AI-powered recommendations has addressed the challenge of selecting products without physical interaction, significantly enhancing the online shopping experience. Competitive pricing, promotional offers, and home delivery services have made online platforms increasingly appealing, especially to younger, tech-savvy consumers. The COVID-19 pandemic accelerated the shift toward digital channels, with many consumers embracing the convenience of ordering eyewear products from the comfort of their homes.

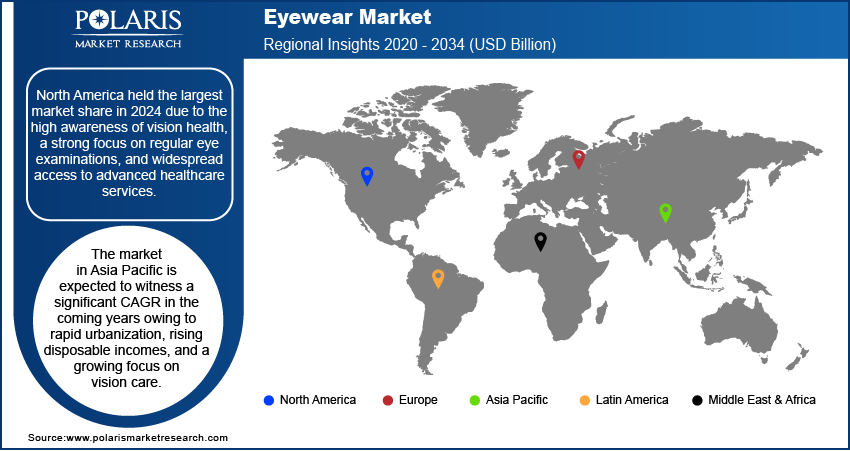

Regional Analysis

The global eyewear market, based on region, is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America held the largest market share in 2024 due to the high awareness of vision health, a strong focus on regular eye examinations, and widespread access to advanced healthcare services. The rising prevalence of vision disorders such as myopia and presbyopia, driven by aging populations and increased digital device usage, significantly contributed to the region's dominance. Consumers in North America show a strong preference for high-quality and technologically advanced products, including blue light-blocking lenses and progressive glasses, further propelling growth opportunities. The region's robust retail infrastructure, including large optical chains and independent optometrists, ensures easy accessibility to a wide range of eyewear products, contributing for the expansion.

The market in Asia Pacific is expected to witness a significant CAGR in the coming years, owing to rapid urbanization, rising disposable incomes, and a growing focus on vision care. Increasing screen time among the younger population, particularly in countries such as China and India, has led to a surge in demand for corrective and protective eyewear solutions. Government initiatives to promote vision health and improve access to affordable eye care services have further spurred growth in the region. China, in particular, stands out as a key country in the Asia Pacific's growth due to its large population base and significant investments in healthcare infrastructure. The rising adoption of stylish and functional products as fashion statements among younger demographics also plays a crucial role in driving eyewear product demand in the region.

Key Companies & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help them to grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

Some of the major players operating in the global industry include Luxottica Group S.p.A.; Bausch + Lomb Inc.; Johnson & Johnson Vision Care; Carl Zeiss AG; GrandVision; Essilor International S.A.; Cooper Companies, Inc.; Fielmann AG; Safilo Group S.p.A.; Prada S.p.A; Hoya Corporation; and De Rigo SpA.

Luxottica Group S.p.A. is an Italy-based eyewear multinational corporation headquartered in Milan. Founded in 1961, it has grown to become one of the world's largest eyewear companies. Luxottica operates as a vertically integrated company, managing the design, manufacturing, distribution, and retail of its eyewear brands through its subsidiaries. In October 2018, Luxottica merged with Essilor to become EssilorLuxottica. Luxottica manages a diverse portfolio of proprietary and licensed brands. Its house brands include Ray-Ban, Oakley, Persol, Oliver Peoples, Alain Mikli, Arnette, Costa del Mar, and Vogue Eyewear.

Carl Zeiss AG, branded as ZEISS, is a German manufacturer of optical and optoelectronic systems founded in Jena, Germany, in 1846. ZEISS is active in four business segments: industrial quality and research, medical technology, consumer markets, and semiconductor manufacturing technology. ZEISS has operations in almost 50 countries, with 30 production sites and around 25 development sites worldwide. ZEISS offers a wide array of products, including lithography optics, microscopes, measuring technology, photomask systems, medical technology products, eyeglass lenses, camera and cine lenses, and binoculars.

List of Key Companies in the Eyewear Industry

- Luxottica Group S.p.A.

- Bausch + Lomb Inc.

- Johnson & Johnson Vision Care

- Carl Zeiss AG

- GrandVision

- Essilor International S.A.

- Cooper Companies, Inc.

- Fielmann AG

- Safilo Group S.p.A.

- Prada S.p.A

- Hoya Corporation

- De Rigo SpA

Eyewear Industry Developments

September 2025: New data for TECNIS IOLs was showcased by Johnson & Johnson at ESCRS 2025. The company also presented the premium IOLs for the TECNIS platform. These included the TECNIS PureSee IOL and TECNIS Odyssey IOL.

July 2025: EssilorLuxottica announced the launch of the Ray-Ban Meta and Oakley Meta Performance AI glasses. These glasses come with advanced AI technology that improves the experience of the wearer.

February 2024: Lenskart, the company known for making prescription and sunglasses, announced the launch of its first-ever smart eyewear that comes with Bluetooth audio to let users listen to their favourite music on the go.

July 2024: EssilorLuxottica signed an agreement to acquire Optical Investment Group and establish its optical retail footprint in Romania to strengthen its prevailing occupancy in the region and consistently follow its objective of providing high-quality vision care worldwide.

June 2024: Bausch + Lomb announced the launch of Bausch + Lomb INFUSE for Astigmatism daily disposable contact lenses in the United States to offer clear, stable vision and all-day comfort and minimize contact lens dryness.

September 2023: Meta, in partnership with EssilorLuxottica, announced the launch of a new generation of Ray-Ban Meta smart glasses at Meta Connect. The new glasses feature improved audio and cameras.

February 2021: Johnson and Johnson Services, Inc. obtained a CE mark for the ACUVUE OASYS MULTIFOCAL contact lens, which is designed for people with presbyopia.

March 2021: JINS eyewear introduced its JINS&SUN sunglasses brand in the United States, featuring 29 shapes and 84 styles.

Market Segmentation

By Product (Revenue, USD Billion, 2020-2034)

- Spectacles

- Lenses

- Sunglasses

By Distribution Channel Outlook (Revenue, USD Billion, 2020-2034)

- Ophthalmic Clinics

- Retail Stores

- Online Stores

By End User Outlook (Revenue, USD Billion, 2020-2034)

- Male

- Female

- Unisex

- Kids

By Regional Outlook (Revenue, USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 197.99 billion |

|

Market Size Value in 2025 |

USD 213.99 billion |

|

Revenue Forecast in 2034 |

USD 437.86 billion |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global eyewear market size was valued at USD 197.99 billion in 2024 and is projected to grow to USD 437.86 billion by 2034.

• The global market is projected to grow at a CAGR of 8.3% during the forecast period.

• North America had the largest share of the global market in 2024.

• Some of the key players in the market are Luxottica Group S.p.A.; Bausch + Lomb Inc.; Johnson & Johnson Vision Care; Carl Zeiss AG; GrandVision; Essilor International S.A.; Cooper Companies, Inc.; Fielmann AG; Safilo Group S.p.A.; Prada S.p.A; Hoya Corporation; and De Rigo SpA.

• The online stores segment is projected for significant growth in the global market.

• The spectacles segment dominated the eyewear market in 2024.