3D Printing Construction Market Size, Share, Trends, Industry Analysis Report

By Construction Type (Modular, Full Building), By Material Type, By Construction Method, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM1666

- Base Year: 2024

- Historical Data: 2020-2023

Overview

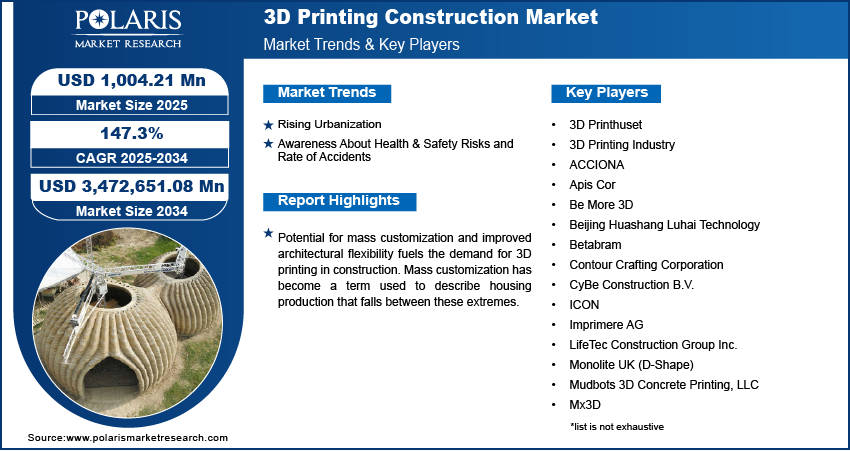

The global 3D printing construction market size was valued at USD 411.93 million in 2024, growing at a CAGR of 147.3% from 2025 to 2034. Key factors driving demand is rising urbanization and awareness about health & safety risks and rate of accidents.

Key Insights

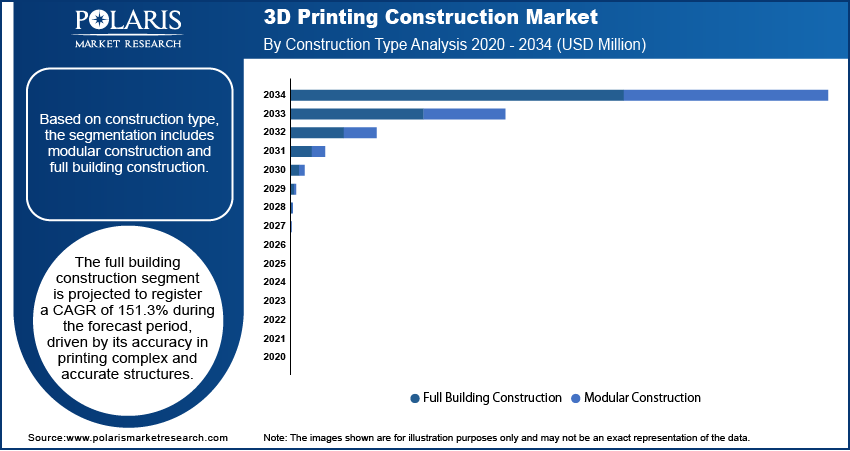

- The full building construction segment is anticipated to register a remarkable CAGR of 151.3% during the forecast period. The dominance is propelled by its ability to accurately produce complex and precise structures using 3D printing technology.

- In 2024, the infrastructure segment accounted for 22.83% of total revenue, supported by the use of large-scale 3D printers that utilize a specialized, thicker-than-normal concrete and composite mixture.

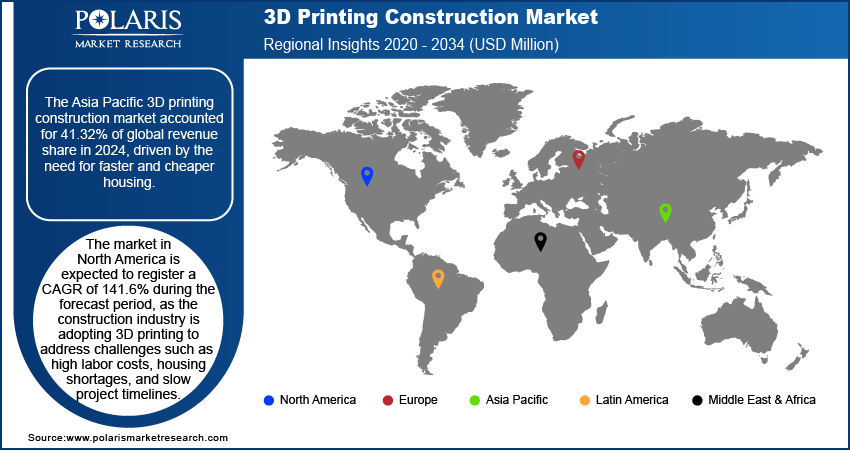

- Asia Pacific dominated the global 3D printing construction market with 41.32% revenue share, driven by the increasing demand for faster and more affordable housing solutions.

- The North America 3D printing construction market is projected to register a CAGR of 141.6% during the forecast period. The construction industry in the region turns to 3D printing technology to combat high labor costs, housing shortages, and lengthy project timelines, which boosts the regional market growth.

- In the U.S., demand for 3D printed construction is on the rise, largely due to the need for cost-effective and rapidly built housing alternatives.

Industry Dynamics

- Rising urbanization is driving the demand for 3D printing construction, catering to the consumers who seek affordable housing.

- Awareness about health & safety risks and rate of accidents are driving the 3D printing construction market.

- Potential for mass customization and improved architectural flexibility fuels the demand for 3D printing in the construction industry.

- High initial investment costs and limited availability of standardized building codes restrains the growth.

Market Statistics

- 2024 Market Size: USD 411.93 Million

- 2034 Projected Market Size: USD 3,472,651.08 Million

- CAGR (2025–2034): 147.3%

- Asia Pacific: Largest Market Share

AI Impact on 3D Printing Construction Market

- AI improves design optimization by analyzing architectural models and structural requirements to generate efficient, material-saving, and structurally sound 3D printable designs.

- Integration of AI enables real-time monitoring and control of printing processes, ensuring precision, consistency, and immediate correction of deviations during construction.

- AI-driven predictive maintenance enhances the reliability of 3D construction printers by detecting wear and potential faults in machinery, reducing downtime and maintenance costs.

- AI supports automated project planning and resource allocation by analyzing site conditions, material availability, and labor needs, accelerating construction timelines and reducing waste.

3D printing construction is used in industries such as building and infrastructure. This method is employed primarily due to its cost-effectiveness, construction time, flexibility, design, error reduction, and environmental aspects. The superior features offered by 3D printing construction are enabling its usage in various end-use industries. For several decades, the construction sector has remained dormant in terms of technological advancements. However, the introduction of 3D printing in construction has gained tremendous popularity, as a greater number of stakeholders are recognizing the true potential of this technology. This has considerably driven the market over the years.

The increasing adoption of building information modelling is driving the adoption of 3D printing in the construction sector. The technology provides a digital blueprint that guides the printing process, enabling greater precision, customization, and efficiency. Building information modelling provides a collaborative platform and shared knowledge resource for architecture, engineering, construction professionals, and other stakeholders for effective execution of planning, design, operational, management, and construction decisions. Additionally, factors such as growth in development of commercial buildings in the emerging economies, rising need for affordable housing solutions, and adoption of environment regulations to reduce carbon emissions fuel the growth.

Potential for mass customization and improved architectural flexibility fuels the demand for 3D printing in construction. Mass customization has become a term used to describe housing production that falls between these extremes. This term, long used by industrial designers, refers to a production system that combines the stability of quantity with the flexibility of custom design. Mass customization leads to lower unit cost, increased quality, and shortened project duration for customized offerings, which is considered highly relevant for tomorrow's house-building industry. 3D printing enables the creation of unique, on-demand structures with personalized features, which reduce waste and optimize material usage, thereby driving the growth.

Drivers & Opportunities

Rising Urbanization: The global urban population is increasing for several reasons, including natural population growth, migration from rural areas, and the expansion of existing cities. According to the World Bank Group, as of 2024, 58% of the world’s population lives in urban areas. This growth has led to a higher demand for buildings, commercial complexes, and individual homes, contributing to the expansion of the construction industry. As a result, there is a growing interest in 3D printing construction among consumers seeking faster, more affordable, and sustainable building solutions, further driving this growth.

Awareness About Health & Safety Risks and Rate of Accidents: The construction industry is labor-intensive, and the most hazardous job in the world. According to the U.S. Department of Labor, in 2023, the construction industry in the U.S. alone recorded 234 work-related injuries and fatalities. For safer construction environments, many researchers who studied the 3D construction techniques considered safety factors from the design and planning stages. Hadipriono and Barsoum developed a virtual environmental model to be used in site workers’ training regarding the fall hazard from scaffolding. They developed the procedures of scaffolding inspection to identify hazardous conditions on scaffolding visually. Consequently, developments like this fuel the adoption.

Segmental Insights

Construction Type Analysis

Based on construction type, the segmentation includes modular construction and full building construction. Full building construction segment is projected to register a CAGR of 151.3% over the forecast period, driven by its accuracy in complex and accurate structures being printed. The use of 3D printing in the initial stages of production is beneficial as designers are able to identify the errors or defects in the build, thereby reducing the production time and operational costs. Materials are utilized efficiently, with no excess material being used. This technology is based on additive manufacturing process, which involves layer-by-layer deposition of materials. Efficient use of material and reduction in wastage are driving the segment growth.

Material Type Analysis

Based on material type, the segmentation includes concrete, metal, composite, plastic, and other material. The concrete segment is expected to witness a significant share over the forecast period. 3D concrete printing is a building technology that uses computer-operated robots, which print 3D structures for buildings and other infrastructure. Software such as AutoCAD or SolidWorks are used to per-program the path of the printer. The concrete that is fed to the printer is dispensed through the nozzle layer-by-layer in the pre-programmed desired path. Different types of concrete, having various types of material composition, are used for 3D printing. Ready-mix and high-density concrete with minor changes in their composition are used for 3D printing.

Construction Method Analysis

In terms of construction method, the segmentation includes extrusion and powder bonding. The powder bonding segment held 22.60% of revenue share in 2024. The `demand for powder bonding process is exhibiting growth due to its ability to produce lightweight structures, provide consistent output repetitively, and the capability of developing consolidated parts, which gradually reduces the time required for assembly. This process provides higher durability and heat resistance while manufacturing complex shapes with a shorter lead time, which is driving the demand for consumers operating in large-scale projects and specialized applications.

End Use Analysis

In terms of end use, the segmentation includes building, residential, commercial, industrial, and infrastructure. The infrastructure segment held a significant revenue share in 2024, holding 22.83%. 3D printing of infrastructure is done using large-scaled printers that produce a special concrete and composite mixture that is thicker than standard concrete. The additional strength enables the concrete to be self-supporting as it sets. The concrete structures are curved and hollowed, allowing for less material to be used with fewer design constraints. This development benefits the construction process and reduces the price level for housing. Additionally, governments of several developed countries are planning to construct new buildings, offices, public toilets, and other infrastructure by using 3D printing technology, thereby driving the segment growth.

Regional Analysis

The Asia Pacific 3D printing construction market accounted for 41.32% of global revenue share in 2024, driven by the need for faster and cheaper housing. Many countries are growing quickly and need to build homes and infrastructure fast. Governments support new technology to save time and reduce building waste. Labor shortages in some areas further make 3D printing attractive. Additionally, smart city projects and green construction goals are common in this region, and 3D printing helps meet those goals. Moreover, companies are investing more in research and development, making the technology better and more affordable, further driving the industry growth in Asia Pacific.

China 3D Printing Construction Market Insights

China held 39.77% of the revenue share in Asia Pacific in 2024, due to China’s rapid urban growth and strong push for innovation. The country seeks faster and more cost-effective ways to construct homes and public buildings. The government supports high-tech solutions that reduce labor costs and help the environment. China’s large construction industry and strong manufacturing abilities make it easy to develop and use the big 3D printers. 3D printing offers cleaner, faster building methods as cities grow and pollution becomes a concern. Moreover, strong policy support, skilled engineers, and a big housing demand further fuel the growth of the industry in China.

North America 3D Printing Construction Market Trends

The market in North America is expected to register a CAGR of 141.6% during the forecast period as the construction industry is adopting 3D printing to address challenges such as high labor costs, housing shortages, and slow project timelines. The technology allows faster and more cost-effective building, which is attractive to developers. There is a strong focus on sustainability, and 3D printing reduces material waste. Government support, especially for affordable housing, is increasing interest in this method. Additionally, research institutions and private companies are investing in 3D printing innovation, further driving the growth of the industry in North America.

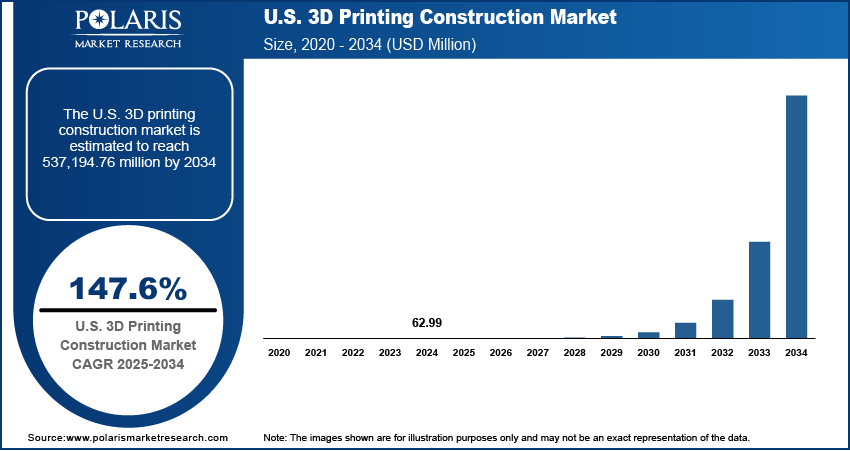

U.S. 3D Printing Construction Market Overview

The demand for 3D printing construction in the U.S is rising due to the growing demand for affordable and quick housing solutions. High labor costs and housing shortages in many regions are encouraging the use of automated construction methods. 3D printing reduces the time and cost of building while supporting sustainable practices through reduced material waste. Several government t and private initiatives are funding 3D printing construction projects. Additionally, the presence of advanced research institutions and tech companies is supporting innovation in this field, thereby boosting the growth in the U.S.

Europe 3D Printing Construction Market Analysis

The industry in Europe is projected to register a CAGR of 127.5% from 2025 to 2034. Europe is promoting 3D printing in construction to support sustainable development and improve construction efficiency. The region has strong environmental regulations, encouraging technologies that reduce material waste and carbon emissions. Many European governments and organizations are investing in automation and digital printing construction methods. The need for affordable housing, especially in urban areas, is further driving demand. Additionally, the presence of advanced manufacturing capabilities and research institutions supports innovation in 3D printing technology. The focus on energy-efficient buildings and reducing construction time further strengthens the adoption of 3D printing across Europe’s construction sector.

Germany 3D Printing Construction Market Assessment

The industry in Germany is projected to register a CAGR of 135.6% from 2025 to 2034, due to its strong engineering sector and focus on technological innovation. The country emphasizes sustainable building practices, and 3D printing helps reduce waste and energy use. High labor costs and the need for faster construction processes make automation a compelling option. Government support for digital construction methods and funding for research projects is further increasing adoption. Additionally, Germany’s advanced infrastructure, skilled workforce, and strong manufacturing base enable the development and use of large-scale 3D printing systems, thereby fueling the growth of the industry.

Key Players & Competitive Analysis Report

The competitive landscape of the 3D printing construction market is dynamic, with key players focusing on innovation, partnerships, and expansion to gain market share. Companies like ICON, Apis Cor, and Contour Crafting Corporation lead with proprietary technologies and high-profile projects. European firms such as XtreeE, CyBe Construction, and WASP emphasize sustainable construction and digital fabrication. WinSun (Yingchuang Building Technique), based in China, is a pioneer in large-scale 3D printed structures. Partnerships, R&D, and government collaborations are common strategies, as seen with Sika AG and ACCIONA. Startups such as Mudbots, Be More 3D, and Total Kustom offer competitive innovation in affordable housing and infrastructure. While North America and Europe are key hubs, emerging activity in Asia-Pacific and the Middle East indicates growing global interest. Overall, the market is moderately fragmented, with rapid technological evolution and increasing adoption across residential, commercial, and industrial sectors driving competition.

Key Players

- 3D Printhuset

- 3D Printing Industry

- ACCIONA

- Apis Cor

- Be More 3D

- Beijing Huashang Luhai Technology

- Betabram

- Contour Crafting Corporation

- CyBe Construction B.V.

- ICON

- Imprimere AG

- LifeTec Construction Group Inc.

- Monolite UK (D-Shape)

- Mudbots 3D Concrete Printing, LLC

- Mx3D

- Sika AG

- Total Kustom

- WASP c/o CSP S.r.l.

- XtreeE

- Yingchuang Building Technique (Shanghai) Co. Ltd. (WinSun)

3D Printing Construction Industry Developments

In April 2025, Slant raised USD 1.5 Million to set up 3D printing farm at Louisville, Kentucky and other major locations. This investment was aimed to reduce the logistics time and scale up the Teleport Print.

In February 2025, Icon secured an investment of USD 56 million in the series C funding. This series of funding is aimed at supporting the development of Phoenix, ICON’s line of multi-story 3D printers.

3D Printing Construction Market Segmentation

By Construction Type Outlook (Revenue, USD Million, 2021–2034)

- Modular Construction

- Full Building Construction

By Material Type Outlook (Revenue, USD Million, 2021–2034)

- Concrete

- Metal

- Composite

- Plastic

- Other Material

By Construction Method Outlook (Revenue, USD Million, 2021–2034)

- Extrusion

- Powder Bonding

By End Use Outlook (Revenue, USD Million, 2021–2034)

- Building

- Residential

- Commercial

- Industrial

- Infrastructure

By Regional Outlook (Revenue, USD Million, 2021–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

3D Printing Construction Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 411.93 Million |

|

Market Size in 2025 |

USD 1,004.21 Million |

|

Revenue Forecast by 2034 |

USD 3,472,651.08 Million |

|

CAGR |

147.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 411.93 million in 2024 and is projected to grow to USD 3,472,651.08 million by 2034.

The global market is projected to register a CAGR of 147.3% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are 3D Printhuset; 3D Printing Industry; ACCIONA; Apis Cor; Be More 3D; Beijing Huashang Luhai Technology; Betabram; Contour Crafting Corporation; CyBe Construction B.V.; ICON; Imprimere AG; LifeTec Construction Group Inc.; Monolite UK (D-Shape); Mudbots 3D Concrete Printing, LLC; Mx3D; Sika AG; Total Kustom; WASP c/o CSP S.r.l.; XtreeE; and Yingchuang Building Technique (Shanghai) Co. Ltd. (WinSun).

The full building construction segment dominated the market revenue share in 2024.

The infrastructure segment is projected to witness the fastest growth during the forecast period.