Melamine Market Share, Size, & Industry Analysis Report

By Type; By Application; By End Use (Construction, Automotive, Chemical, Textiles, and Others); and By Region, Segment Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 158

- Format: PDF

- Report ID: PM1542

- Base Year: 2024

- Historical Data: 2020-2023

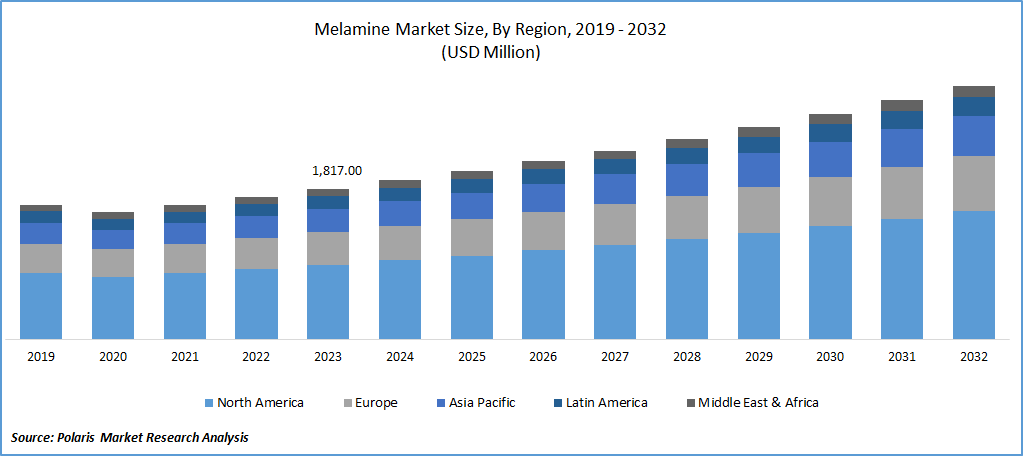

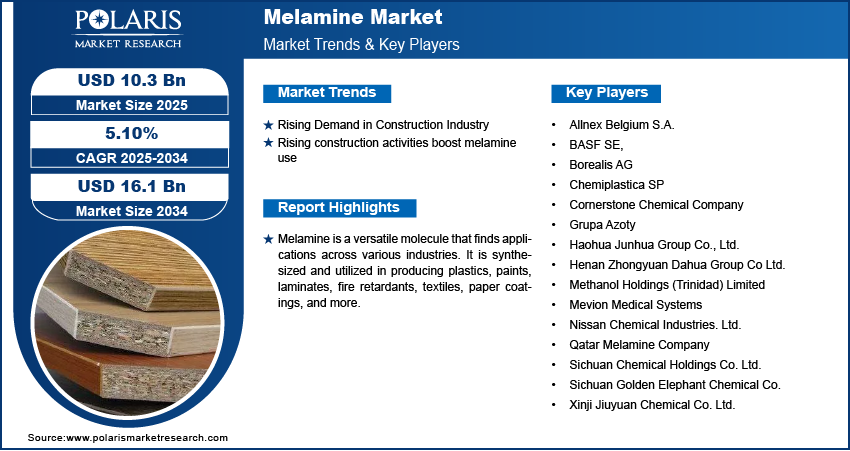

The global melamine market was valued at USD 9.8 billion in 2024 and is anticipated to grow at a CAGR of 5.10% from 2025 to 2034. The market is driven by extensive use of melamine in laminates, adhesives, and coatings in various end-use industries such as construction, automotive, wood adhesive, paints and coatings, and packaging. Moreover, the rising preference for sustainable products is expected to create lucrative growth opportunities for the market as consumers.

Key Insights

- The melamine resins segment is projected to grow at the highest CAGR, fueled by rising demand for laminated furniture, durable surface materials, and growing usage across construction and automotive industries for enhanced aesthetics and strength.

- In 2024, the laminate segment led the melamine market due to its cost-effectiveness, low maintenance needs, design versatility, and durability, making it a preferred choice in residential, commercial, and industrial applications.

- The wood adhesives segment is expected to grow steadily, supported by increased demand in the furniture and construction industries for strong bonding solutions, alongside the rising trend of engineered wood and composite panels.

- Asia Pacific dominated the melamine market in 2024 and is expected to retain its lead, driven by rapid urbanization, infrastructure development, and strong manufacturing activity in emerging economies like China and India.

Industry Dynamics

- Rising demand for melamine resins in furniture, construction, and automotive sectors is driving the melamine market, supported by their durability, heat resistance, and suitability for decorative surfaces and laminates.

- Expanding applications in laminates, adhesives, coatings, and molding compounds are creating new growth avenues, driven by consumer preference for cost-effective, high-performance materials across residential, commercial, and industrial sectors.

- Challenges such as fluctuating raw material prices, environmental regulations, and health concerns related to formaldehyde emissions may limit market growth and require innovation in eco-friendly melamine-based products.

- Technological advancements in production processes and increased use of melamine in engineered wood and sustainable construction materials are boosting efficiency, performance, and demand in both developed and developing regions.

Market Statistics

- 2024 Market Size: USD 9.8 billion

- 2034 Projected Market Size: USD 16.1 billion

- CAGR (2025-2034): 5.10%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Melamine is a versatile molecule that finds applications across various industries. It is synthesized and utilized in producing plastics, paints, laminates, fire retardants, textiles, paper coatings, and more.

Additionally, it is used in manufacturing automotive interior components, coatings, and adhesives, capitalizing on the growing automotive industry's need for lightweight and durable materials. The furniture industry also extensively utilizes melamine, particularly in producing decorative laminates and veneers, driven by urbanization and evolving lifestyle trends.

Furthermore, melamine-based resins play a significant role in creating food packaging materials, including melamine foam, due to the increasing emphasis on food safety and sustainable packaging solutions. The demand for melamine in these sectors is expected to rise as industries prioritize quality, performance, and environmental considerations.

The rise in demand from the automotive industry is a key driver as manufacturers seek melamine for applications such as automotive coatings and adhesives. The increasing demand for wood adhesives and laminates also contributes to market growth. Factors like higher disposable income and changing consumer preferences and lifestyles drive the market forward.

The increasing utilization of melamine as a strong and lightweight material in the automotive industry and rising demand from the packaging sector will drive market growth. Melamine is commonly used to produce food packaging materials such as plates, bowls, and cups due to its excellent resilience and heat and chemical tolerance.

Government regulations to reduce formaldehyde emissions from wood-based products will also grow market revenue. Melamine resins produce wood-based goods like MDF, particleboard, and plywood. Melamine is an ideal choice for complying with these regulations as it can effectively lower formaldehyde emissions from these products, ensuring compliance with government laws.

The increasing use of melamine in the automotive industry, demand from the packaging sector, and the need to comply with formaldehyde emission regulations in wood-based products are key drivers of market revenue growth.

Market Dynamics

- Rising Demand in Construction Industry

The demand for melamine is expected to increase in construction manufacturing, driven by its use in wood adhesives, interior designing, floor coatings, and laminating wooden panels. In the construction sector, melamine in concrete, specifically Superplasticizers (SMF), enhances workability and fluidity while reducing water requirements during handling and pouring. Melamine-based insulation foams are also utilized in commercial spaces like offices, restaurants, and educational institutions to provide acoustic solutions for room dividers, hanging baffles, ceiling tiles, and wall-mounted absorbers.

Melamine, as a thermosetting plastic, finds applications in the manufacturing of various products such as kitchenware, laminates, specialized paints, flame-retardant textiles and apparel, particleboards, floor tiles, and flexible urethane foam used for insulation in the construction industry. The growing adoption of lightweight plastic crockery items, driven by increasing disposable income, is expected to fuel the demand for melamine further.

The market growth may need to be revised due to stringent government regulations imposed by authorities. For example, the Food Safety and Standards Authority of India (FSSAI) changed its rules to include melamine level standards in baby formula and other food products, reflecting the concern for consumer safety and product quality. Compliance with such regulations may challenge the melamine market during the forecast period.

Report Segmentation

The melamine market is primarily segmented based on type, application, end-use, and region.

|

By Type |

By Application |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The melamine resins segment is expected to witness the highest CAGR during the forecast period, driven by the growing demand for laminated furniture and its wide-ranging applications in industries such as construction and automotive. Melamine resins are extensively used to produce various items, including kitchenware, laminates, tile floors, overlay materials, and particleboards.

Additionally, these resins can be altered into rigid foam structures with specific porous configurations. They find utility as insulators, soundproofing materials, and cleaning abrasives. The increasing awareness of these diverse applications of melamine resins is expected to further boost the growth of this segment during the forecast period.

By Application Analysis

In 2024, the laminate segment held the largest share of the melamine market, driven by its favorable properties such as affordability, low maintenance, high performance, and wide design choices. Melamine resin provides a durable and visually appealing finish to these typically lower-quality materials, contributing to increased laminate demand.

The wood adhesives segment is anticipated to experience steady growth over the forecast period. Melamine adhesives are known for creating strong bonds without causing damage to the surfaces being joined. By dispersing the bond's tension evenly across the surface, additives in melamine adhesives reduce the risk of pressure fractures induced by screws and other fasteners, further enhancing the appeal of these adhesives in the cabinet and woodworking industry.

By Regional Analysis

In 2024, Asia Pacific accounted for the largest market share and maintained its dominance during the forecast period, primarily driven by the presence of key developing economies and the rapid urbanization witnessed in countries such as China and India. The region's thriving construction industry, fueled by rising disposable incomes and an improved standard of living, is also expected to contribute to the Asia Pacific melamine market expansion during the forecast period. Additionally, China, one of the major consumers and manufacturers of industrial products, is projected to hold a significant market share throughout the forecast period.

Key Players and Competitive Insights

The melamine market is a dynamic and competitive industry characterized by a range of players contributing to the production, distribution, and innovation of melamine-based products. Melamine, a versatile chemical compound, is widely used in the production of resins, laminates, coatings, and flame retardants, among other applications. The market players in the melamine industry are engaged in continuous research and development, strategic collaborations, and expansion initiatives to gain a competitive edge.

A few major players operating in the global melamine market include

- Allnex Belgium S.A.

- BASF SE,

- Borealis AG

- Chemiplastica SP

- Cornerstone Chemical Company

- Grupa Azoty

- Haohua Junhua Group Co., Ltd.

- Henan Zhongyuan Dahua Group Co Ltd.

- Methanol Holdings (Trinidad) Limited

- Mevion Medical Systems

- Nissan Chemical Industries. Ltd.

- Qatar Melamine Company

- Sichuan Chemical Holdings Co. Ltd.

- Sichuan Golden Elephant Chemical Co.

- Xinji Jiuyuan Chemical Co. Ltd.

Recent Developments

- In February 2025, BASF launched Basotect EcoBalanced, the first melamine foam with a 50% lower carbon footprint. Made with renewable waste-based materials and green electricity, it supports sustainable sound absorption for transportation and construction industries.

- In February 2022, EuroChem offered to acquire Borealis AG's nitrogen, fertilizer, and melamine business. However, in March 2022, Borealis AG denied the offer. While the company rejected the offer, it remains open to exploring opportunities for its nitrogen business.

- In September 2022, Eurotecnica secured two significant contracts to construct high-pressure melamine plants. The contracts entail the implementation of plants with capacities of 60,000 tons and 80,000 tons per year, respectively.

Melamine Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 10.3 billion |

|

Revenue forecast in 2034 |

USD 16.1 billion |

|

CAGR |

5.10% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical data |

2020–2023 |

|

Forecast period |

2025–2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

A few global key market players are Qatar Melamine Company, Borealis AG, Cornerstone Chemical Company, and Nissan Chemical Industries.

The global melamine market is expected to grow at a CAGR of 5.10% during the forecast period.

The melamine market report covers key segments such as type, application, end-use, and region.

Increasing demand for melamine in the construction industry drives the market growth.

The global melamine market size is expected to reach USD 16.1 billion by 2034.