Clinical Laboratory Tests Market Size, Share, Trends, & Industry Analysis Report

By Type (Clinical Chemistry Testing, Hematology Testing, ), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM1854

- Base Year: 2024

- Historical Data: 2020-2023

Overview

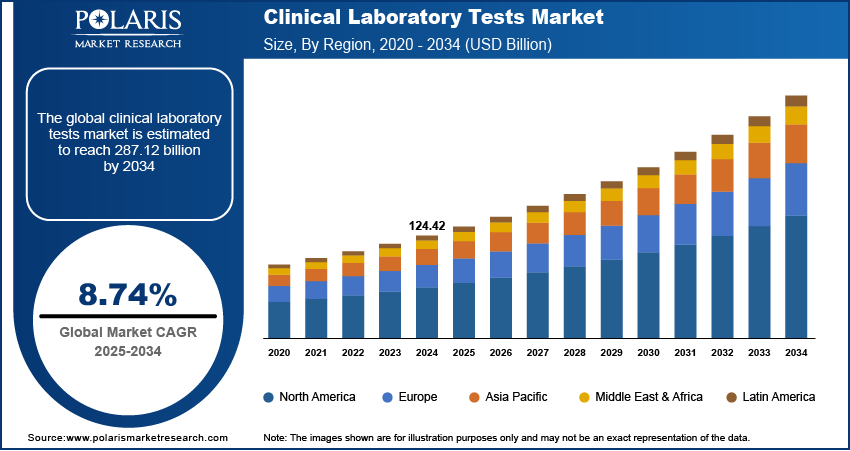

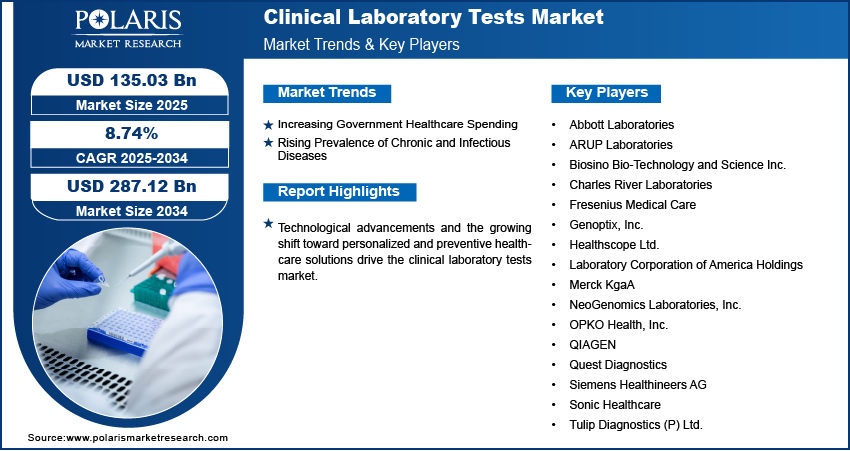

The global clinical laboratory tests market size was valued at USD 124.42 billion in 2024, growing at a CAGR of 8.74% from 2025–2034. Key factors driving demand include growing geriatric population, increasing awareness and focus on preventive healthcare, increasing government healthcare spending, and rising prevalence of chronic and infectious diseases.

Key Insights

- Clinical chemistry segment held the largest revenue share in 2024, due to their basis in routine medical checkup and care.

- The primary clinics segment is projected to grow at a robust 8.6% CAGR, driven by demand for point-of-care testing and better diagnostic access.

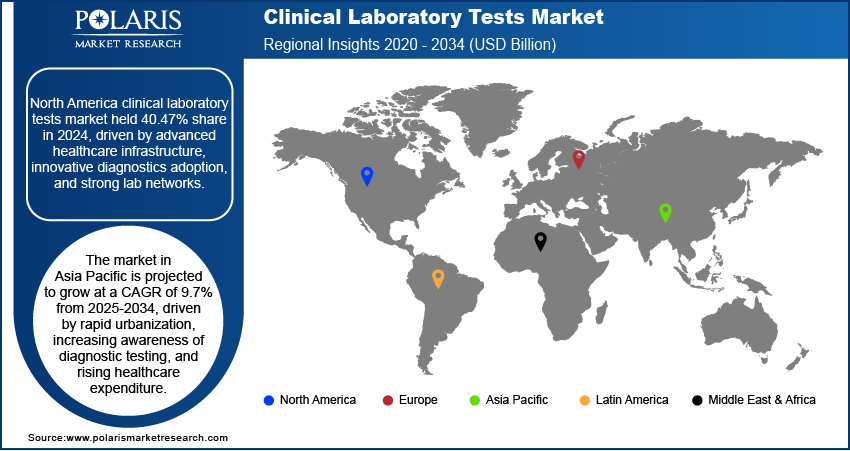

- North America held a dominant 40.47% global market share in 2024, due to its advanced infrastructure and adoption of new diagnostic technologies.

- The U.S. held a 96.68% share of the North American market in 2024, supported by its advanced healthcare system and focus on preventive care.

- The Asia Pacific market is forecasted to grow at a 9.7% CAGR from 2025 to 2034, driven by urbanization and increasing healthcare spending.

- China's market is expected to capture a 29.48% share by 2034, driven by healthcare expansion and growing diagnostic awareness.

Industry Dynamics

- Increased government healthcare spending expands access to diagnostics and funds screening programs, which boosts demand for laboratory tests.

- The growing burden of chronic and infectious diseases necessitates more frequent testing for patient monitoring and effective treatment management.

- Rising pressure to reduce healthcare costs squeezes laboratory profit margins, making it difficult to invest in new, advanced testing technologies.

- The growing demand for personalized medicine and early disease detection creates a major opportunity to develop and offer novel, specialized diagnostic tests.

Market Statistics

- 2024 Market Size: USD 124.42 billion

- 2034 Projected Market Size: USD 287.12 billion

- CAGR (2025-2034): 8.74%

- North America: Largest market in 2024

AI Impact on Clinical Laboratory Tests Market

- AI-powered diagnostic systems are automating routine testing processes, reducing human error, and increasing laboratory throughput while lowering operational costs for healthcare providers.

- Machine learning algorithms analyze test patterns to predict disease earlier, enabling preventive care strategies and improving patient outcomes through timely medical interventions.

- AI enhances precision diagnostics by analyzing genetic data and biomarkers, enabling the development of customized treatment plans and targeted therapies for individual patients.

- AI adoption is driving expansion, attracting venture capital investments, and creating new revenue streams while improving diagnostic accuracy and laboratory competitiveness globally.

Clinical laboratory tests are diagnostic procedures conducted on samples of blood, urine, or other tissues to evaluate health conditions and detect diseases.

The growing geriatric population drives the market, as aging individuals are more inclined to chronic illnesses, metabolic disorders, and immune system decline, necessitating regular testing and monitoring. The demand for precise laboratory diagnostics continues to rise, with the elderly being more susceptible to conditions such as cardiovascular diseases, diabetes, and cancer. An October 2024 WHO report estimated that by 2030, one in six people will be over 60. This age group is expected to reach 1.4 billion, doubling to 2.1 billion by 2050, with those over 80 years old tripling. This demographic shift increases the reliance on clinical laboratories to provide timely and accurate assessments, thereby reinforcing their role as an essential component of healthcare delivery.

The increasing awareness and focus on preventive healthcare, which highlights early disease detection and proactive health management, further contribute to the growth opportunities. Efficacy testing encourages individuals to undergo routine laboratory screenings even in the absence of symptoms, enabling early intervention and reducing the burden of advanced-stage diseases. Clinical laboratory tests serve as a vital tool for monitoring risk factors, identifying potential health threats, and guiding medical decisions as healthcare systems worldwide promote wellness initiatives and lifestyle-related health programs. This growing focus on prevention supports better patient outcomes and also enhances the long-term demand for comprehensive diagnostic services.

Drivers & Opportunities

Increasing Government Healthcare Spending: Increasing government healthcare spending is driving the expansion opportunities as it directly improves access to diagnostic services and strengthens healthcare infrastructure. A 2025 World Economic Forum report stated that global health spending reached USD 9.8 trillion in 2021, representing 10.3% of the world's GDP. Public health systems expand laboratory facilities, integrate advanced testing technologies, and allocate higher budgets to subsidize diagnostic services for larger populations. This increased financial support enables the broader implementation of screening programs, early disease detection initiatives, and chronic disease management, all of which rely heavily on clinical laboratory tests. As a result, government investment enhances the affordability and availability of tests, while also facilitating growth in demand by promoting equitable access to healthcare across diverse demographics.

Rising Prevalence of Chronic and Infectious Diseases: The rising prevalence of chronic and infectious diseases is driving the market, as it increases the demand for accurate and timely diagnostics. Conditions such as diabetes, cardiovascular disorders, cancer, and respiratory infections require continuous monitoring and frequent testing to guide effective treatment plans and improve patient outcomes. According to an October 2024 CDC report, 60% of Americans have at least one chronic disease, while 40% live with two or more. Similarly, the spread of infectious diseases highlights the need for rapid identification, surveillance, and management through laboratory-based testing. Clinical laboratories serve as a cornerstone in confirming diagnoses, tracking disease progression, and evaluating therapeutic responses. As the global burden of both chronic and infectious conditions continues to grow, reliance on laboratory testing is increasing, making it an essential component of modern healthcare systems.

Segmental Insights

Type Analysis

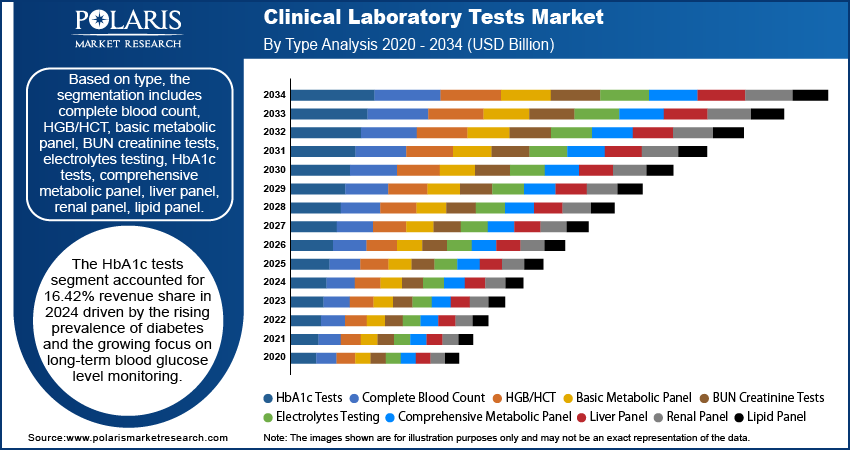

Based on type, the segmentation includes clinical chemistry testing, hematology testing, immunology & serology testing, molecular diagnostics, others. In 2024, clinical chemistry segment held the largest revenue share due to their basis in routine medical checkup and care. These tests are essential for the initial screening process, disgnosis, and management of high cases of chronic disease globally, such as diabetes, renal disorders, and cardiovascular diseases. The rise in volume of these tests is driven by their integration in routine or standard health checkup and crucial metabolic panels, which are the most preferred assays in clinical environment. Furthermore, these methodologies are high in standard and flexible for full automation to enable high-throughput analysis with cost-efficiency and turnaround times. The universal clinical necessity, operationsl scalability, and other ensure the dominant position of this segment in the evolving market.

End Use Analysis

In terms of application, the segmentation includes central laboratories, primary clinics. The central laboratories dominated the market with 64.48% revenue share in 2024 due to their capacity to handle high test volumes and utilize advanced diagnostic technologies. These facilities are equipped with automated systems, skilled personnel, and comprehensive test portfolios, making them the preferred choice for hospitals and healthcare providers. Their ability to deliver accurate, large-scale testing within shorter turnaround times strengthens their dominance in the market. Additionally, the integration of central laboratories with advanced data management systems further enhances efficiency and reliability, reinforcing their leading position.

The primary clinics segment is expected to witness robust growth with 8.6% CAGR during the forecast period driven by rising demand for point-of-care diagnostic and enhanced accessibility to routine diagnostics. Primary clinics offer convenience for patients seeking immediate health evaluations, enabling quicker decision-making and treatment initiation. The growing focus on preventive healthcare, along with the shift towards decentralized testing models, supports the rise of diagnostic services in primary clinics. Their ability to provide affordable, accessible, and patient-centered testing solutions is expected to expand their role within the clinical laboratory testing market.

Regional Analysis

North America clinical laboratory tests market accounted for 40.47% of global market share in 2024. This dominance is attributed due to its advanced healthcare infrastructure, high adoption of innovative diagnostic technologies, and established laboratory networks. The region benefits from strong research and development activities, as well as widespread awareness of preventive healthcare, which drives consistent demand for laboratory tests. Moreover, the region’s strong focus on early disease detection and management supports the dominance of clinical laboratory services in the global market.

U.S. Clinical Laboratory Tests Market Insight

U.S. held 96.68% market share in North America clinical laboratory tests landscape in 2024 due to its advanced healthcare infrastructure, widespread adoption of diagnostic technologies, and strong focus on preventive care. High healthcare expenditures, supported by robust laboratory networks and service providers, contribute to the country's leading position in healthcare. Furthermore, the growing prevalence of chronic diseases and focus on early detection continue to fuel the demand for laboratory testing services.

Asia Pacific Clinical Laboratory Tests Market

The market in Asia Pacific is projected to grow at a CAGR of 9.7% from 2025-2034, driven by rapid urbanization, increasing awareness of diagnostic testing, and rising healthcare expenditure. According to World Bank data, health spending in East Asia & the Pacific accounted for 6.59% of the region's GDP in 2022. The area is experiencing a rise in chronic diseases, which is increasing the need for prompt and precise laboratory services. Advancements in healthcare infrastructure, with the adoption of modern diagnostic technologies, are further supporting market expansion. The shift towards preventive and personalized healthcare continues to strengthen the demand for clinical laboratory tests across the region.

China Clinical Laboratory Tests Market Overview

The market in China is expected to capture 29.48% share by 2034 driven by the rapid expansion of healthcare facilities, rising diagnostic awareness, and increasing investments in medical technology. The country’s large population base and growing urbanization are contributing to higher demand for both routine and specialized testing services. Additionally, government initiatives aimed at enhancing healthcare accessibility and integrating advanced laboratory systems are expected to drive market growth.

Europe Clinical Laboratory Tests Market

The clinical laboratory tests landscape in Europe held 28.80% share in 2024 attributed to its well-established healthcare systems and strong focus on quality diagnostic services. The region places a high focus on preventive care, routine screenings, and the management of chronic diseases, driving the adoption of advanced laboratory testing. The presence of skilled professionals and strict regulatory standards ensures high precision and dependability of laboratory results. Europe’s rising innovation in diagnostics and patient-centric healthcare continues to boost its substantial presence in the global market.

Germany Clinical Laboratory Tests Market

The market in Germany is driven by its robust healthcare system, strict regulatory standards, and strong focus on quality diagnostics. The country benefits from a well-developed network of laboratories that provide accurate and reliable testing, supporting both preventive and therapeutic care. Furthermore, advancements in laboratory automation and digital health solutions are enhancing both efficiency and patient outcomes, thereby strengthening Germany’s position in the European clinical laboratory tests market.

Key Players & Competitive Analysis Report

The clinical laboratory tests sector operates within a highly competitive landscape where both major industry players and small to medium-sized enterprises are strategically positioning themselves to achieve substantial revenue growth. This competitive environment is driving companies to develop refined intelligence capabilities and adaptive strategies that respond to rapidly changing market conditions.

The industry is currently witnessing a transformation driven by two primary technological trends that are reshaping the entire ecosystem. Automation technologies are transforming laboratory operations by improving efficiency, reducing human error, and enabling a higher throughput of diagnostic tests. Simultaneously, the advancement of personalized medicine is creating new paradigms for patient care, requiring more sophisticated and targeted diagnostic approaches that can deliver individualized treatment insights. These technological developments are generating substantial expansion opportunities across diverse geographic markets. In developed markets, the focus is on upgrading existing infrastructure and implementing cutting-edge technologies to maintain a competitive advantage.

Major companies operating in the clinical laboratory tests industry include Abbott Laboratories; ARUP Laboratories; Biosino Bio-Technology and Science Inc.; Charles River Laboratories; Fresenius Medical Care; Genoptix, Inc.; Healthscope Ltd.; Laboratory Corporation of America Holdings (LabCorp); Merck KgaA; NeoGenomics Laboratories, Inc.; OPKO Health, Inc.; QIAGEN; Quest Diagnostics; Siemens Healthineers AG; Sonic Healthcare; and Tulip Diagnostics (P) Ltd.

Key Players

- Abbott Laboratories

- ARUP Laboratories

- Biosino Bio-Technology and Science Inc.

- Charles River Laboratories

- Fresenius Medical Care

- Genoptix, Inc.

- Healthscope Ltd.

- Laboratory Corporation of America Holdings (LabCorp)

- Merck KgaA

- NeoGenomics Laboratories, Inc.

- OPKO Health, Inc.

- QIAGEN

- Quest Diagnostics

- Siemens Healthineers AG

- Sonic Healthcare

- Tulip Diagnostics (P) Ltd.

Industry Developments

- April 2025: Quest Diagnostics launched a blood test combining AB 42/40 and p-tau217 biomarkers to help confirm amyloid pathology in Alzheimer's patients with MCI or dementia. It uses mass spectrometry and immunoassay techniques.

- June 2024: PHASE Scientific Americas launched two at-home collection kits, the INDICAID health Diabetes HbA1c Kit and Heart Health Lipid Panel Kit, allowing individuals to monitor average blood sugar and cholesterol/triglyceride markers using self-collected samples analyzed by certified laboratories.

Clinical Laboratory Tests Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Clinical Chemistry Testing

- Routine Chemistry Testing

- Specialized Chemistry Testing

- Hematology Testing

- Immunology & Serology Testing

- Molecular Diagnostics

- Infectious Disease Testing

- Genetic Testing

- Molecular Microbiology

- Transplant Diagnostics

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Central Laboratories

- Primary Clinics

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Clinical Laboratory Tests Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 124.42 Billion |

|

Market Size in 2025 |

USD 135.03 Billion |

|

Revenue Forecast by 2034 |

USD 287.12 Billion |

|

CAGR |

8.74% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 124.42 billion in 2024 and is projected to grow to USD 287.12 billion by 2034.

The global market is projected to register a CAGR of 8.74% during the forecast period.

North America clinical laboratory tests market accounted for 40.47% of global market share in 2024.

A few of the key players in the market are Abbott Laboratories; ARUP Laboratories; Biosino Bio-Technology and Science Inc.; Charles River Laboratories; Fresenius Medical Care; Genoptix, Inc.; Healthscope Ltd.; Laboratory Corporation of America Holdings (LabCorp); Merck KgaA; NeoGenomics Laboratories, Inc.; OPKO Health, Inc.; QIAGEN; Quest Diagnostics; Siemens Healthineers AG; Sonic Healthcare; and Tulip Diagnostics (P) Ltd.

Clinical chemistry segment held the largest revenue share in 2024.

The primary clinics segment is expected to witness robust growth with 8.6% CAGR during the forecast period.